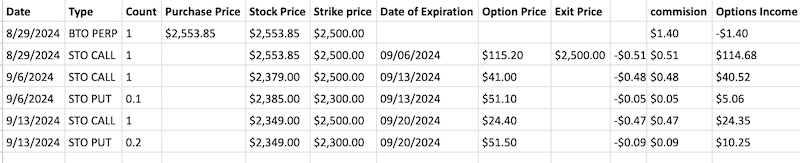

On August 29, 2024, I initiated a covered call strategy by purchasing a long ETH perpetual futures contract at $2,553. To generate income, I sold an in-the-money (ITM) call option with a $2,500 strike price, expiring on September 6.

When ETH traded at $2,383 on expiration day, the call option expired worthless. This allowed me to roll the position forward to September 13, 2024, while keeping the same strike price and collecting $41 in premium. I also sold a short put with a $2,300 strike price, earning $5.1.

Adjusting the Strategy on September 13

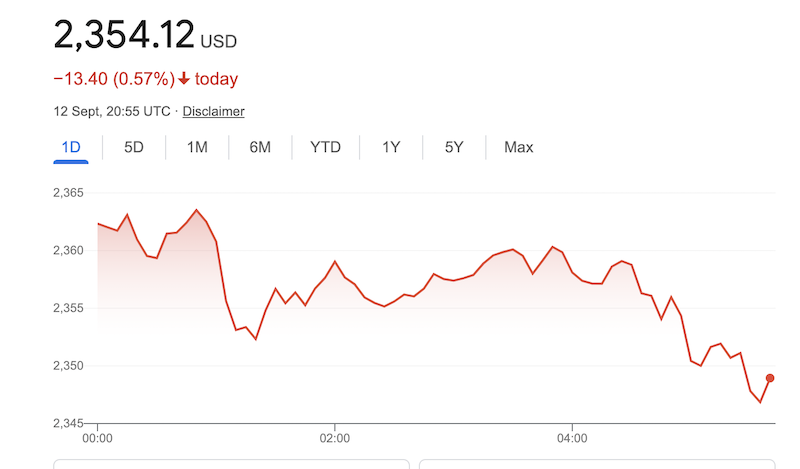

With ETH trading at $2,350 on September 13, well below my strike price of $2,500, I decided to roll my position forward again. I sold another call option with the same strike price of $2,500, this time with an expiry date of September 20, collecting $24 in premium.

Additionally, I sold 0.2 short put options with a $2,300 strike price, earning $51 in total premium. This is a strategic move to continue accumulating premiums while managing the downside risk.

Updated Trade Setup:

- Sold 1 CALL SEP 20 '24 2,500 Call Option: Premium: $24

- Sold 0.2 PUT SEP 20 '24 2,300 Put Option: Premium: $51

Rolling Strategy and Flexibility

This strategy allows for a rolling adjustment to market conditions, keeping me flexible in case of further declines or a potential rally in ETH. By rolling the call options and selling additional puts, I can continue to generate income, with the opportunity to accumulate ETH at lower price points if the market drops.

Total Premium Collected So Far:

Here’s a summary of all premiums collected since August 29:

- $115 from the initial call option sale

- $41 from the rolled call option (September 13)

- $5.1 from the short put option (September 13)

- $24 from the rolled call option (September 20)

- $10.25 from the new short put (September 20)

Total premium collected: $195.35

Adjusted Breakeven Point

With ETH currently trading below my initial purchase price, my breakeven has been adjusted to reflect the premiums collected. Here’s the updated calculation:

- Initial ETH purchase price: $2,553

- Premiums collected: $195.35

New breakeven = $2,553 - $195.35= $2,357.65

This means that as long as ETH stays above $2,357.65, I’m still in a profitable position.

Evaluating Future Scenarios

Scenario 1: ETH Rallies Above $2,500

If ETH rallies above $2,500 by September 20, my call option will be exercised. I’ll sell ETH at $2,500, which is still below my initial purchase price but offset by the premiums collected, making it a profitable trade overall.

- Selling ETH at $2,500

- Total premium collected: $295.35

- Breakeven price: $2,357.65

Maximum profit: $142.35 ($2,500 - $2,357.65)

Scenario 2: ETH Drops Below $2,350

If ETH drops further, I’ll continue to roll my call options and sell more puts. If ETH falls below $2,300, my short puts may get assigned, allowing me to accumulate more ETH at a better price point. This method aligns with my long-term goal of building my ETH position to 2 ETH over time, adding 0.1 ETH each week.

Next Steps: Increasing Contract Size

Next week, I plan to increase my trading contract size to 1.3 ETH, continuing to sell calls and puts. By maintaining this rolling strategy, I can generate consistent income, accumulate ETH, and manage the volatility inherent in the crypto markets.

- In total 6 trades since August 29, 2024

- Options premium: $193.46

- Break Even: $2,360

This trade is part of my ongoing journey with the TerraMatris Crypto Hedge Fund, where disciplined risk management and strategic planning play a crucial role in navigating the ever-volatile crypto markets.

This rolling strategy, involving both call and put options, continues to give me flexibility and income generation potential. As I aim to increase my position size, I’ll remain focused on maximizing opportunities in the ETH market while mitigating risks along the way.