Good morning, ladies and gentlemen. My name is Reinis Fischer, I'm CEO and founder of Terramatris Crypto Hedge Fund. Today is May 2nd, 2024, and it's time for our weekly wrap-up about happenings in the fund, crypto markets, and life in general. So let's begin.

Before we dive into the details about the interesting happenings in the crypto market, let me give you a brief overview of what Terramatris Crypto Hedge Fund is.

Terramatris is a private crypto investment hedge fund managed by me, Reinis Fischer. It is privately held and not publicly registered, though it's available for investment over Raydium. The fund is mostly operated from Georgia.

Disclaimer: Investments in stocks, funds, bonds, or cryptos are risk investments, and you should do your own due diligence before investing in any kind of asset.

That said, let's quickly cover our trading strategy at TerraMatris. Here at Terramatris, we mostly trade one-day-to-expire put options on Bitcoin. Additionally, we sell covered calls on already established positions. Currently, we have positions on Ethereum and Solana. We feel super safe about covered calls because we already hold these positions. We are not using any leverage at all, and covered calls are the best thing that can be in our portfolio because the funds invested in covered calls are actually made from put options, so they're fully covered.

All the premium we are making from selling put or call options, we are investing it back into crypto itself. So far, we have chosen a few coins: Bitcoin, Ethereum, Stellar Lumens, USDC, Solana, Jupiter, and this week we added one really interesting coin, which is Token Fi. Token Fi is a coin or token for the so-called real-world asset tokenization, which is something we believe has very huge potential for explosive growth.

Actually, if I can give a little glimpse of about two years ago, back in April 2022, while vacationing in Batumi, Georgia, looking up on Batumi real estate projects, I came up with this idea to issue a token, raise funds, and from the funds raised, to buy an apartment in Batumi.

I made a so-called white paper on my personal blog. If you're following Terramatris, my blog, my YouTube channel, LinkedIn, you already know. I have also my blog where I cover many other topics, not only crypto or hedge fund things.

Fast forward, this didn't work as expected, but I was able to attract an investor. Hey, Uday, if you see me, hi to Canada! A few months later, we bought an apartment. We started buying, acquiring an apartment in Tbilisi, but unfortunately, the developer is just not building our property, and now we are in the process of recovering some of the funds.

A few days ago, another investor mentioned potential investments in Malaysia, which is something I'm not very much familiar with, and I started looking into potential investment opportunities in Malaysia. While looking, I was thinking, remembering about those real-world asset tokens, and we just added a few real-world asset tokens to our portfolio. That's how we get to this, I think, amazing to our portfolio.

So, that said, in this week, Week 37, we have been reinvesting all the premium back into Solana and this new Token Fi. Dollar-cost averaging.

Risk management is very important, especially in these times. When selling put options, one of the first and most important things we are looking for are high probability options trades that are going to expire worthless. But in case they're not, we are rolling forward for a credit, means we buy back our contracts and sell new ones, preferably for credit, with a lower strike price but with an expiry in a future date.

We might hedge with Futures, we might use stop losses, and additionally, we are constantly not buying more than 45 days to expiry long put options. But this is something we have been eyeing, buying those more than 45 days to expiry put options, long options, in case there's a market downtrend, which is happening right now. It would pump up our portfolio.

Unfortunately, we're not holding a lot of those options at the moment, and they are not helping to pump our portfolio at this moment. So it's probably a mistake we haven't implemented as much as we are talking about them. I keep talking about them every week but forget to implement them. Maybe it would help our portfolio a little bit, but it's something we haven't implemented yet. If there is a market correction at the moment, I wouldn't call this a crash, so definitely, we're going to have more than 45 days expiry put options in the coming weeks or months, who knows.

This week for Terramatris, we set a humble minimum $6 daily goal from options. I have to say it's not working as expected because we decided to stop selling new options while we are in recovery mode in trade adjustments.

In short, we're holding a few, we don't want to blow up our portfolio right now. Our portfolio is almost perfectly balanced. We have positions, we have some cash, we can sell calls. We are not selling new put options because we have a few put options already established, so we need to wait for them to expire worthless or adjust them, roll forward, and receive credit.

At this moment, there are no new cash inflows every day, but we have cash in the portfolio, so we are still buying. We are still buying some crypto, and we are using those $6, so we have plenty of cash to allow us to last for a few months with such an investment approach, but of course, we are planning to raise this goal week after week.

I have to say, a few weeks ago, we were targeting about $15, we just scaled back a little bit this week. We have been reinvesting all the premium back not in Bitcoin as it said here, but we have been reinvesting back in Solana and this Token Fi.

Optionally, we haven't been buying any more than 45 days to expiry put options. My fault, my fault. Let's see how our weekly results are going.

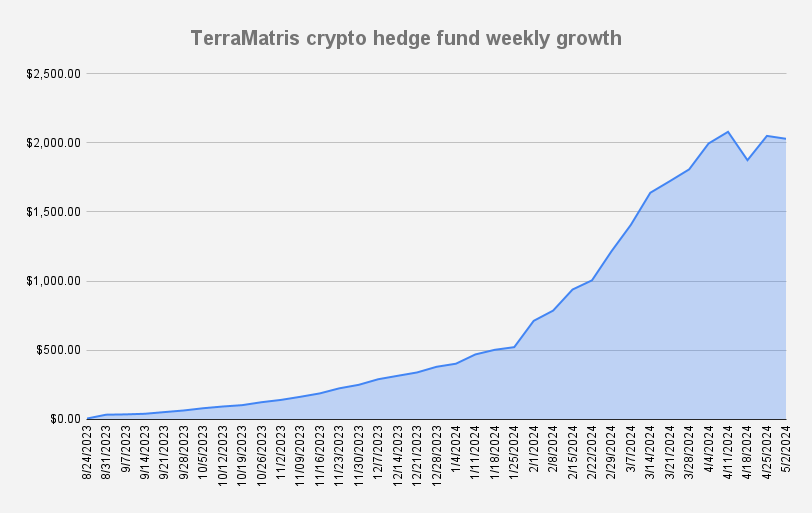

And I have to say, despite a very steep market drop, price drop for Bitcoin, we managed this week, on May 2nd, to reach $2,029, which is a slim minus 1% week-over-week decrease, which is fine in their terms. We have lost minus $21,12. Again, most of the time, we didn't get any new cash flow, but we still got yesterday, we got some cash added to the portfolio from the performance fees for our private customers for whom we are trading crypto, and the performance fee and funding fee addition helped us to bump our portfolio a little bit.

Without that, it would be about a -4 - 5% decrease, but I would say that's not bad compared to Bitcoin itself, which yesterday dropped like 9%, so I'm looking at this quite optimistically.

Now, let's see how our trade adjustments are going.

In total, we are holding 0.11 Bitcoin put options with several strike prices and expiry dates in May. The closest one is this Saturday, May 3rd. We're holding 0.4 put options on Bitcoin with a strike price of $67,500. This seemed like a perfectly safe trade. The day before yesterday, we opened it was a $61,000 put option, but yesterday, in the last one or two hours of trading, it dropped very steeply under $57,000, and we just were like, besides that, we have a few other positions on Bitcoin expiring also this May.

Most probably, we will need to adjust them because unless Bitcoin is not recovering above $65,000, we will need to adjust them. There is a slim chance that Bitcoin might adjust above $65,000 this month, but I highly doubt it.

Speaking of that, about market trends and analysis, at this moment, we are in a pretty bearish market, so we can see this steep drop happening. It dropped from $63,000 to $57,000 overnight, and it has been dropping since ever since April 10 or something. It's soon going to be one month.

What is the problem with these charts? If you look at these charts, these are 50 to 200 moving-day averages. I am quite cautious about what might happen next. I'm expecting we are due for a possible pullback to $52,000 or $49,000, and I would even dare that we might touch $42,000, and then we could start seeing some recovery.

I might be wrong, and I wish I would be wrong, and we might start a nice shoot to the stars from this point, but the chances are every day the chances are getting more and more slim on that, but I hope to be wrong. I like to be wrong and make a nice profit.

What I have to mention when we look at these charts, the relative strength index is showing that we are in an oversold position at this moment, so there is a chance that some possible pullback is possible and so I would expect, well, we could test $60,000, $61,000, but the main thing we have to see is this upper moving average. I think this is a 200-day moving average, which is about $63,000. If it's not going to break it, it's going to definitely shoot down again. If it's going to break it, then there's a chance for us to see some all-time highs again.

That said, let me return to our native token, TerraM. Terramatris Hedge Fund has its own token.

In total, there are 10,000 tokens available for investment over the Solana blockchain. It's possible to swap USDC for TerraM on Raydium or Jupiter platforms. At the moment, 344 TerraM tokens are available for investment over those platforms, and the starting price per one token is $1.17. If you want to buy more on the platform, the price is going to increase steeply. If you want to buy at a fixed price, let's say 200 tokens, you can contact me or connect with me on LinkedIn and discuss how to buy some of the tokens for your exposure.

Yep, so that said, that's pretty much all I wanted to say today. Thanks for watching, trade safe, and see you next week.