Good morning, everyone! It's February 15, 2024, and I'm Reinis Fischer, the CEO and founder of TerraMatris Crypto Hedge Fund. Today, I'm coming to you from the Axis Towers Lobby in Tbilisi, Georgia. Ready to recap the exciting events in our crypto hedge fund's portfolio from last week.

Before we dive in, I want to remind you that TerraMatris operates as a private group investment hedge fund, specializing in cryptocurrency. While we're not publicly registered, we're always open to potential investors who are interested in joining our exclusive community.

Swap USDC for TerraM on Raydium

Now, let's talk about our trading strategy. At TerraMatris, we keep things simple and straightforward. We primarily focus on trading one-day options, predominantly on Bitcoin and occasionally Ethereum. We also engage in selling call options and holding long Ethereum futures. The premiums we receive from these options are reinvested back into the portfolio, allowing us to grow our investments in various coins, including Bitcoin, Ethereum, Stellar Lumens, and USD stablecoin.

Risk management is paramount in our strategy. We adhere to four core principles: seeking high-probability options trades, implementing trade adjustments when necessary, employing hedging strategies like futures and stop losses, and holding longer-term put options as protection against market downturns.

Setting weekly goals is essential for us. Last week, our target was to generate a minimum of $9 / daily from options premiums while reinvesting those profits into Ethereum. Although we considered purchasing longer-term put options, we ultimately focused on growing our portfolio without incurring additional expenses.

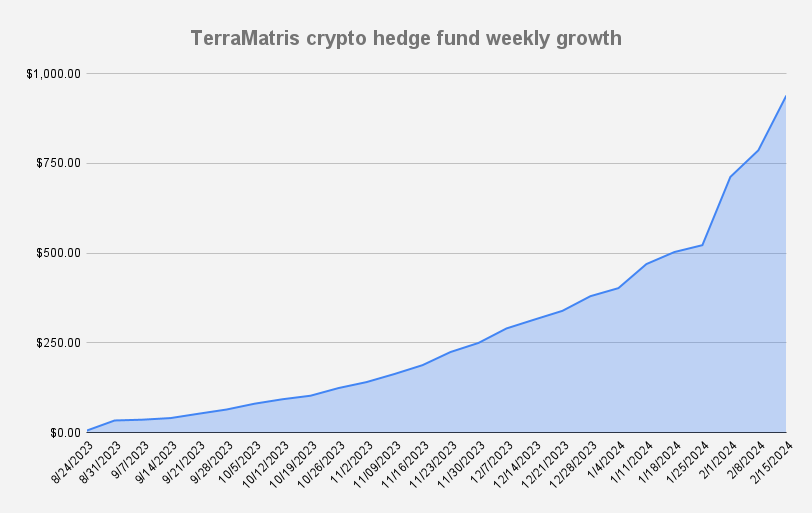

Now, let's discuss the exciting news from last week: our portfolio reached an all-time high of $939.15, representing a remarkable 19% week-over-week growth. This growth is attributed to both options premiums and the appreciation of cryptocurrencies in our portfolio.

Moving on to market analysis, Bitcoin surpassed the $50,000 mark, a significant psychological level. While we remain optimistic about Bitcoin's long-term prospects, we anticipate possible pullbacks in the short term, potentially to $44,000 or even $38,000. However, we maintain a bullish outlook, with targets of $57,000 to $58,000 and a retest of all-time highs at $66,000.

Despite our optimism, we acknowledge the inherent volatility of short-term options trading. While Bitcoin's rapid fluctuations pose challenges, we stay humble and vigilant, prepared to adjust our strategies as needed.

In addition to our trading activities, we're excited to announce our upcoming e-book on selling put options on crypto, which will be available on Amazon soon. This book aims to provide valuable insights into income-generating strategies within the cryptocurrency market, catering to the growing interest in this area.

Thank you for joining me today! Stay tuned for more updates, and remember to stay safe and informed in your trading endeavors. Talk to you soon!