Hello, fellow crypto enthusiasts! I'm thrilled to share some exciting news with you today. As the CEO and founder of Terramatris, a private crypto investment fund, I'm constantly striving to navigate the dynamic world of digital assets. Today, on February 1st, 2024, I'm delighted to provide you with an overview of our recent activities and market analysis. So, let's dive in!

Before we delve into the specifics, let me provide a brief overview of Terramatris. It's a private crypto investment fund managed by yours truly, Reinis Fischer. While the fund is not publicly registered, it offers investors the opportunity to swap USDC for TerraM, our native token, on the Raydium liquidity pool.

At Terramatris, we employ a unique trading strategy focused on one-day expiry put options in Bitcoin. This approach, often referred to as zero-day expiry by some, involves meticulous attention to detail, including monitoring Greeks and technical indicators. We reinvest all premiums from options trades back into crypto, primarily allocating funds to Bitcoin, Ethereum, Stellar Lumens, and USDC.

Risk management is paramount in our trading endeavors. We prioritize high-probability options trades, hedging with futures when necessary, and rolling positions forward to mitigate potential losses. While we haven't utilized stop losses yet, we're considering longer-term put options as a safeguard against unforeseen market events.

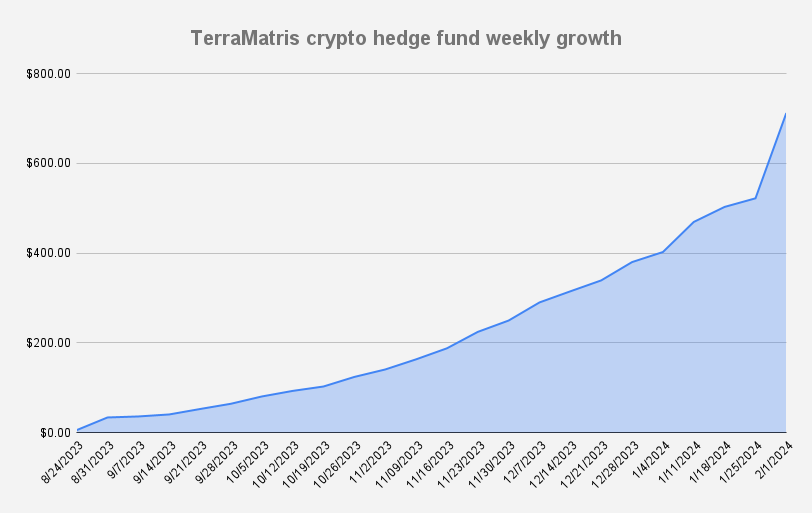

Each week, we set ambitious goals for premium growth while reinvesting profits into Bitcoin. Week 24 was no exception, as we achieved remarkable growth, reaching an all-time high of $712.45. This represents a staggering 36% increase week over week, driven not only by options premiums but also by an unexpected windfall in the form of Jupiter coins from a Solana Phantom airdrop.

Our focus on Bitcoin options trading keeps us closely attuned to market trends. While Bitcoin's price fluctuated around $40,000-43,000, we remained vigilant, anticipating potential dips to $34,000-37,000. Despite market volatility, we maintain a neutral stance, continuously monitoring movements and adjusting our strategies accordingly.

A question I often receive is regarding the significance of Terramatris tokens. Simply put, these tokens represent ownership stakes in the fund. With 10,000 tokens available on the SOL blockchain, investors have the opportunity to participate in Terramatris's success and benefit from our profitable trading endeavors.

Swap USDC for TerraM on Raydium

In conclusion, Week 24 has been a remarkable journey for Terramatris. Our commitment to strategic trading, risk management, and continuous improvement has yielded exceptional results. As we look ahead, we remain focused on delivering value to our investors and navigating the ever-evolving landscape of cryptocurrency. Thank you for joining me on this journey, and I look forward to sharing more updates with you next week!

Remember, investing in cryptocurrencies carries inherent risks, and it's essential to conduct thorough due diligence before making any investment decisions. If you have any questions or suggestions, please don't hesitate to reach out. Until next time, happy investing!