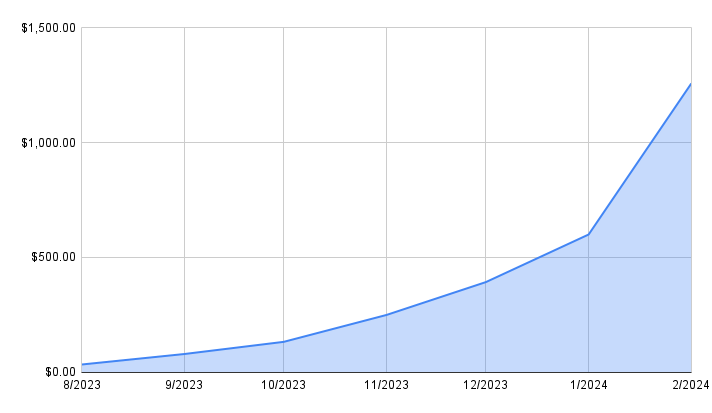

Terramatris is a private crypto investment hedge fund started on August, 2023, by me. The fund is privately held and is not publicly registered under any specific jurisdiction. Though, most of the time operated from Tbilisi, Georgia.

In this article I will shed some light on happenings in the portfolio last month.

February was stellar in terms for the crypto growth, we managed to double our main crypto fund in short 29 days. Besides that I got one customer for the hedge fund, investing directly EUR 1,000. And I'm really proud saying that our first customer is my mom.

We made a special deal, where we agreed on monthly distribution from the fund to give a little boost to her small pension. Having mom as our first customer puts double responsibly to play extra safe, keep the initial funds while having the growth.

Also to keep it in frames as hedge fund, we agreed on 2% management fee and 20% performance fee. And I'm glad to inform that this investment turned out successful - in the month of February, we managed to earn $55.61 before performance fees, that would put this return at about 5.19% before commissions or about 4.15% after hedge fund commissions. I feel really happy about performance so far.

Additionally I was in talks with some Venture capitalists, got refusal from one Kazakh investment venture firm.

In the talks with the second potential, Gen Z, customer with small $1,000-$2,000 potential investment in TerraM token and directly in the fund itself

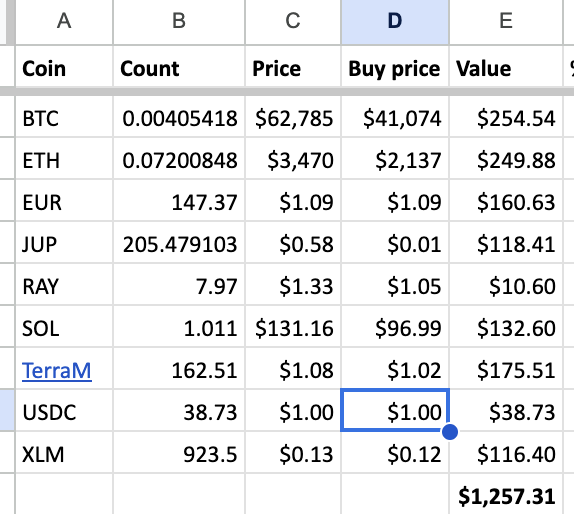

We trade options with crypto while reinvesting premiums back into different crypto assets. At the moment we are growing our crypto portfolio by selling put options on Ethereum and Bitcoin. Once we will have at least 0.1 ETH or 0.01 BTC we will start selling covered calls on these positions to boost the total return. Occasionally we sell covered calls on long ETH futures.

Interested crypto investors can SWAP USDC for TerraM tokens on the Raydium Decentralized exchange.

During the month of February, there were no additional investment attracted to the TerraM coins on the Raydium liquidity pool, all the growth comes from the options trading, Jupiter coin airdrop, crypto gains, management, performance and carry trades.

We got free 200 JUP coins at the start of February, which gave some nice bump to the total portfolio.

In February 2024 I was able to grow our crypto hedge fund to a whopping $1,257.31. The total fund's growth during the month was $657.49, which is about $22.67 daily.

Crypto hedge fund now grows not only from options trades and crypto appreciation, it also grows from income from funding fees on carry trades, management and performance fees. We look on this income as quite safe, and market neutral. In February $43.64 were made from market neutral trades. Whihc is awesome

Month over month we recorded 109.61% growth, and I would be really delighted if we would keep such growth in the future months, but I also understand that might be very challenging, not to say highly unlikely.

At the end of February 2024 TerraM crypto hedge funds' total value was $1,257.31 (+657.49) if compared to January 2024)

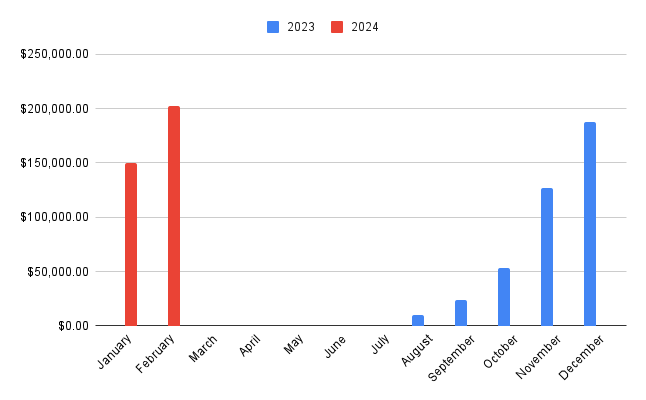

Options trading Volume

In February our funds trading volume for the first time cracked $200,000. We have set our eyes reaching 1 Million in trading volume by the end of the year

Options trades and premium

In total we made 56 options trades last month, collecting $283.7 in options premium mostly from 1DTE options trades on Bitcoin. At the end of the month there are no trade adjustments.

Carry Trade with XRP

Additionally to income from options trades in the month of February we made additional $11.04 from carry trade on XRP. From the capital invested in carry trade ($599) that would give about 1.84% monthly yield. Awesome. We are quite satisfied with the returns form the carry trades and I'm looking to grow our carry trade portfolio ever month but by bit.

I invested additional $100 in XRP carry trade. Now holding 1382 XRP while shorting with the same amount XRP perpetual futures contract. In case we will be able to repeat 1.84% funding fee return in March, we might be looking at about $14.96 additional income. Quite decent.

Management Fee and Performance fee

As we welcomed our first customer with smaller $1,074 investment, we took 21.48 management fee, also booked $11.12 performance fee at the end of the month. Both fees are reinvested back into TerraM token

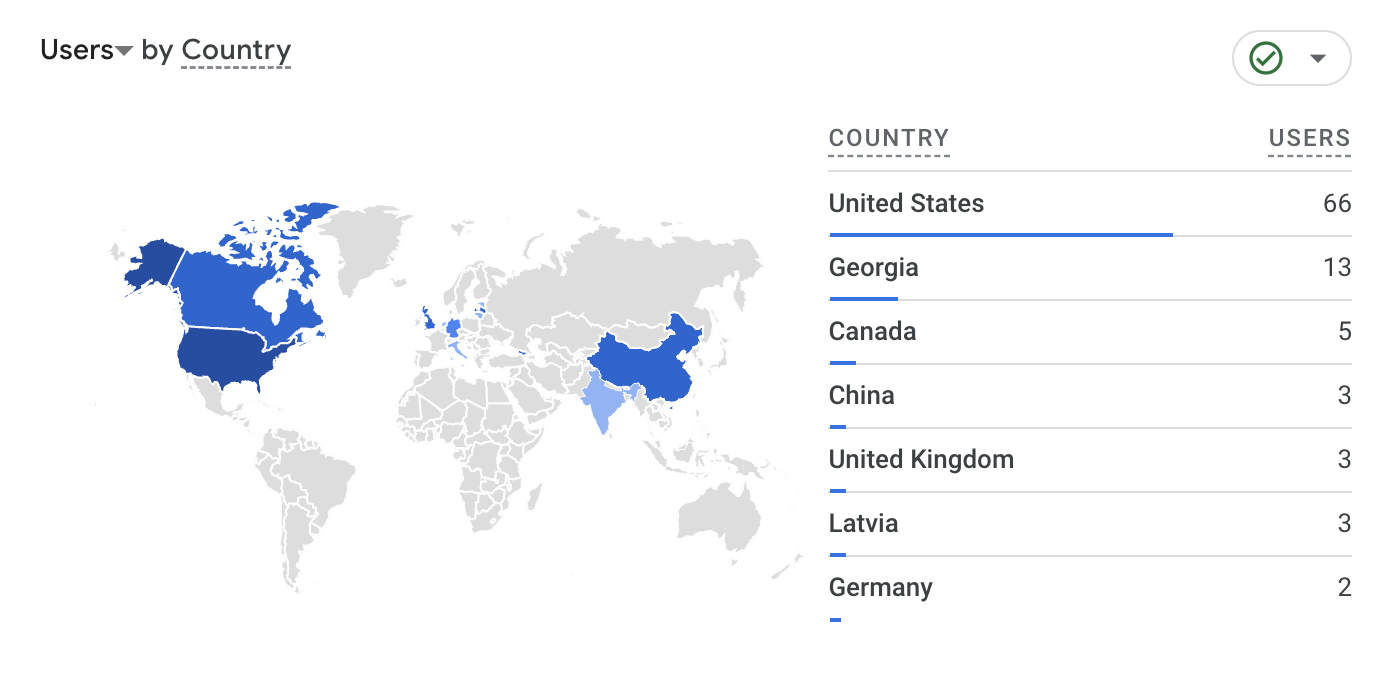

Website Traffic

I have setup a simple website, informing potential investors about the fund, having blog with videos e.t.c. In month of February Terramatris website was visited 103 times, with most of the visitors coming from the US.

Compared to January 2024, website experience 51.9% traffic drop. I dont have a good explanation here, except, maybe back in January, website was visited by some bots. Anyhow, as we are growing the fund and TerraM token organically, I hope the website will help to achieve our longer term goals.

TerraM token

Last month we staked additional 70 TerraM tokens on Raydum liquidity pool. In total there are 234 TerraM tokens available for Swapping against USDC.

You can participate in TerraMatris crypto hedge fund by owning TerraM coin.

Each TerraM token corresponds to a 1/10,000th share in the fund, allowing investors to gain exposure to a diversified range of assets and strategies. This not only spreads risk but also offers a chance to benefit from the fund's performance.

Learn How To Buy TerraM Token Using USDC coin and Phantom wallet

Goals for March 2024

For the month of March 2024, I would be delighted to see funds value grow to $1,500-$1,600

If you are interested in learning more or participating in the fund directly (minimum investment $10,000) - feel free to write me an email to reinis.fischer {at} terramatris.eu or connect on LinkedIn