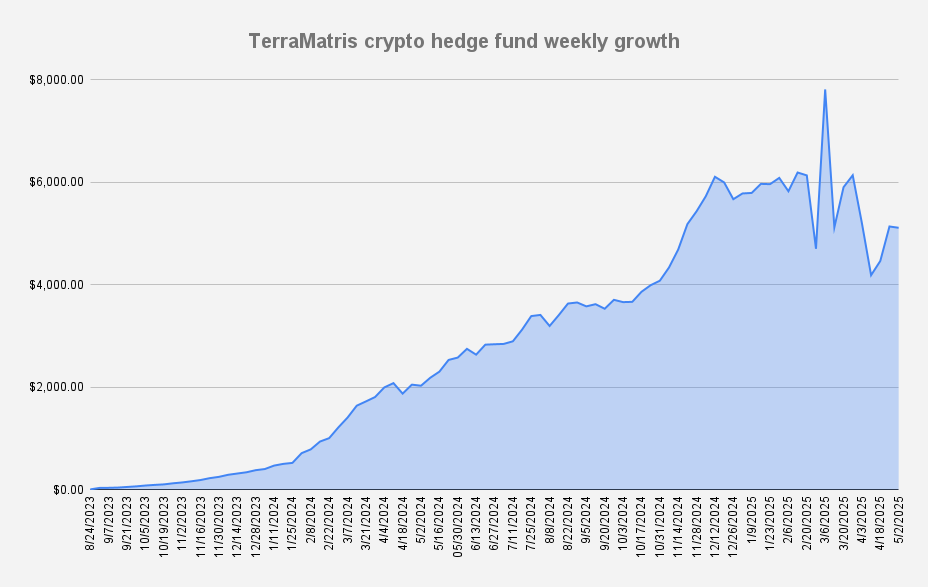

As of May 2, 2025, the fund's value stands at $5,122, reflecting a small weekly decrease of 0.5% or -$25. Despite this dip, it was actually a strong week for us — the drop is primarily due to repaying $276 in debt, not poor performance.

We are still -34.58% below our all-time high of $7,811 (recorded on March 6, 2025), while the fund's year-to-date performance is -9.98%.

Portfolio Activity

This week, we bought back 0.1 ETH from our perpetual futures and converted it into spot holdings. Our spot ETH now totals 1.94, while our ETH perpetual position is down to 2.

We’re continuing our strategy to gradually unwind underperforming positions, aiming to buy back a bit each month. The goal is to eventually close or break even on them. In the meantime, we're selling options each week to generate premium income and support the fund.

Current Long Perpetual Futures (USDC Settled)

- 0.02 BTC – Break-even: $115,490 | Short strike: $94,000

- 2 ETH – Break-even: $2,761 | Short strike: $1,750

- 5 SOL – Break-even: $170.85 | Short strike: $144

We sell weekly options every Friday, which is why this update is published at the end of the week. With markets rebounding (Bitcoin is trading around $96,000), we had to roll up strike prices significantly today.

We earned $95.70 in premiums this week — a small but meaningful addition.

No new funds were added this week, and liquidity remains a top priority.

TerraM Token Update

The TerraM token remains stable at $2.60, with little price movement in recent weeks. We're focused on improving liquidity, but no major buybacks or liquidity increases are planned until the fund reaches at least $8,000 in value.

This update is for informational purposes only and should not be considered financial advice. Always do your own research before making investment decisions.