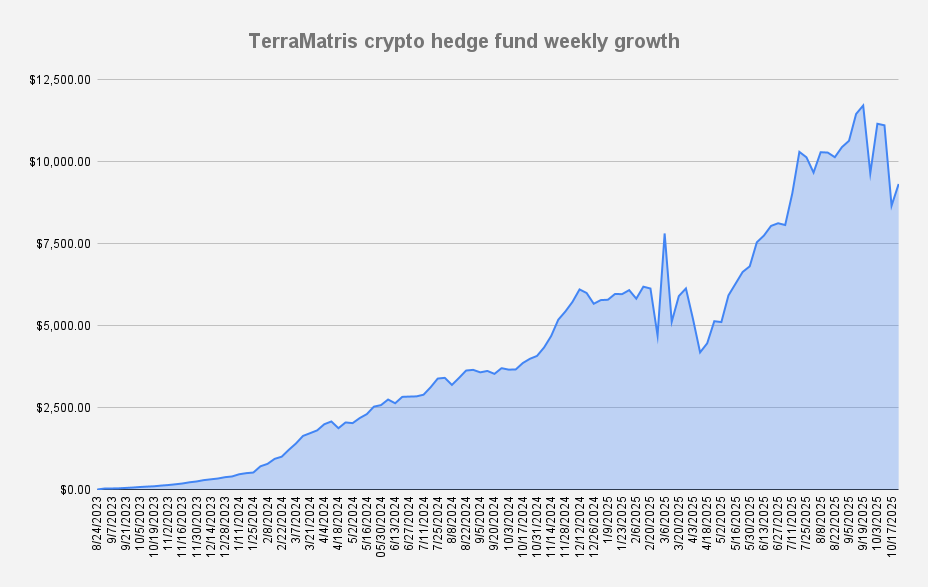

As of October 24, 2025, the TerraM Multi Asset Crypto Options Fund reported a net asset value of $9,325, showing decent recovery of +7.67% from the previous week.

The past few weeks have been characterized by significant volatility, with the market showing no clear directional bias. As option sellers, we remain aware of the possibility of a substantial correction before any sustained recovery occurs. Current conditions remain choppy, though we certainly hope this cautious outlook proves unnecessary.

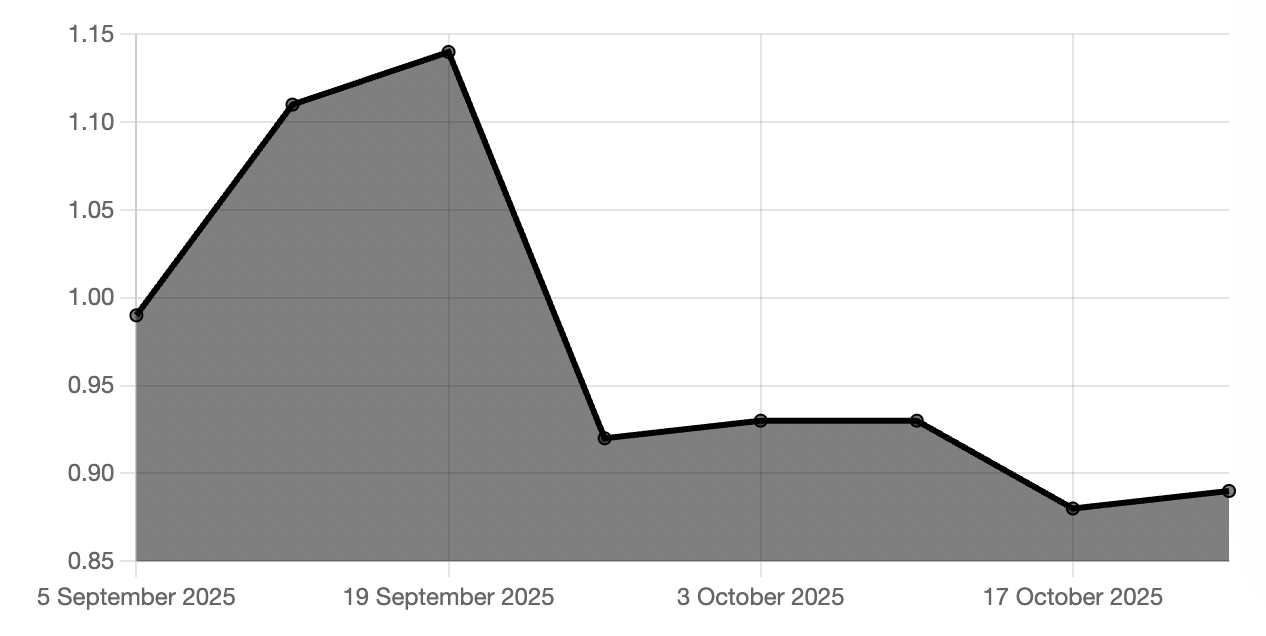

The Solana Covered Call Growth Fund continued its steady performance, generating weekly options income above the 1% target for the first time, which was fully reinvested into SOL to strengthen its core long position. As a result, the NAV per unit increased to $0.89, reflecting sustained portfolio growth and disciplined income compounding.

Additionally, the TERRAM Token remained stable grow by +$0.02, reaching $3.15, reflecting a solid long-term holder base and limited speculative trading.

Besides our work with digital assets, this week, we also attended the Tbilisi Silk Road Forum in Georgia, connecting with leaders from banking, government, and asset management.

During the event, we had the opportunity to meet and exchange handshakes with Prime Ministers from Armenia, Azerbaijan, and Georgia. Moving from the political to the executive side, it was a great honor to connect with governors from the national banks of Armenia, Georgia, Kazakhstan, and Croatia, as well as numerous venture capitalists and capital allocators. However, our favorite encounter probably was meeting a chess prodigy who has defeated Garry Kasparov and even played against Mikhail Tal.

TerraM Multi-Asset Crypto Options Fund

This was a good week for our Multi-Asset Crypto Fund, recovering from the sharp decline of the previous week. While there’s still a way to go for a full recovery, we’re strengthening our positions by reducing leverage — reinvesting options premiums back into spot rather than opening new positions. Our main focus remain BTC, ETH and SOL, with smaller exposure to altcoins

From the previous all-time high, we’re still down –20.42%, while year-to-date performance remains at a healthy +60.78%.

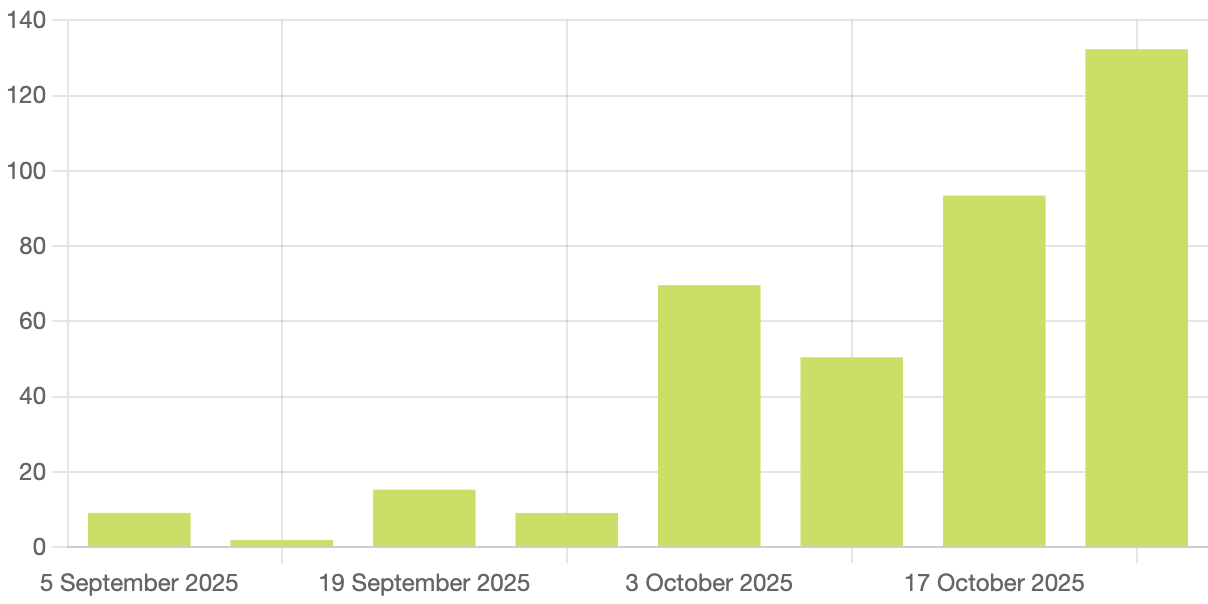

Options Income

We sell weekly options every Friday, which is why this update is published at the end of the week.

This week, the TerraM Fund earned $171 in options premiums, translating to a 1.83% weekly return on capital. As our target is anything above 1%, we’re more than satisfied with this result.

For October, we’ve set a baseline target of $165 per week in options premiums, and so far, the plan continues to perform well.

Trades and Adjustments (USDT Settled / Weekly)

- 1.38 ETH – Break-even: $4,282 | Long calls: $4,100 (0.88), $4,200 (0.4) | Short put: $3,800 (0.1)

- 13 SOL – Break-even: $212.06 | Long calls: $206

- 0.02 BTC – Break-even: $115,140 | Long calls: $117,000

Solana Covered Call Growth Fund

The Solana Covered Call Growth Fund continues to grow steadily. NAV per unit stands at $0.89 which is a growth of +4.14% week over week.

During the week, we generated $132 in options premiums, equal to a 1.22% weekly return on capital. All proceeds were reinvested into spot SOL, bringing the fund’s total holdings to 25.05 SOL at an average cost of $207.51 while the break even price is $193.43

For the first time, we’ve surpassed $100 in weekly options premiums. To be precise, this amount comes from selling monthly options, so we don’t expect to consistently exceed $100 per week until the end of November. In the meantime, we anticipate weekly premiums in the range of $50–$60.

TERRAM Token

To enhance liquidity in the TERRAM:USDC trading pair, Terramatris has allocated 19% of the options-generated income from the TerraM Multi-Asset Crypto Options Fund toward liquidity provisioning and an additional 1% toward token buybacks for market stability purposes.

These actions are intended solely to reduce trading slippage and improve market efficiency, making TERRAM tokens more readily available within the ecosystem. As liquidity increases, Terramatris anticipates smoother trading conditions. Individuals interested in obtaining or selling TERRAM tokens are encouraged to do so exclusively through decentralized exchanges (DEXs) to ensure transparency and integrity in all transactions.

- Fully Diluted Market cap: $31,500

- Total supply: 10,000

- In circulation: 1,947 (19.47%)

- On Liquidity pool: 491 (4.91%)

- Price per token: $3.15 | Swap on Raydium, Jupiter or OKX.com (Solana supported wallet required)

Disclaimer

This communication is confidential and intended solely for designated recipients. It is not for public distribution, reproduction, or forwarding. The information contained herein is provided for informational purposes only and does not constitute investment advice or solicitation.

Participation in Terramatris-managed funds is restricted and not available to U.S. citizens or residents.