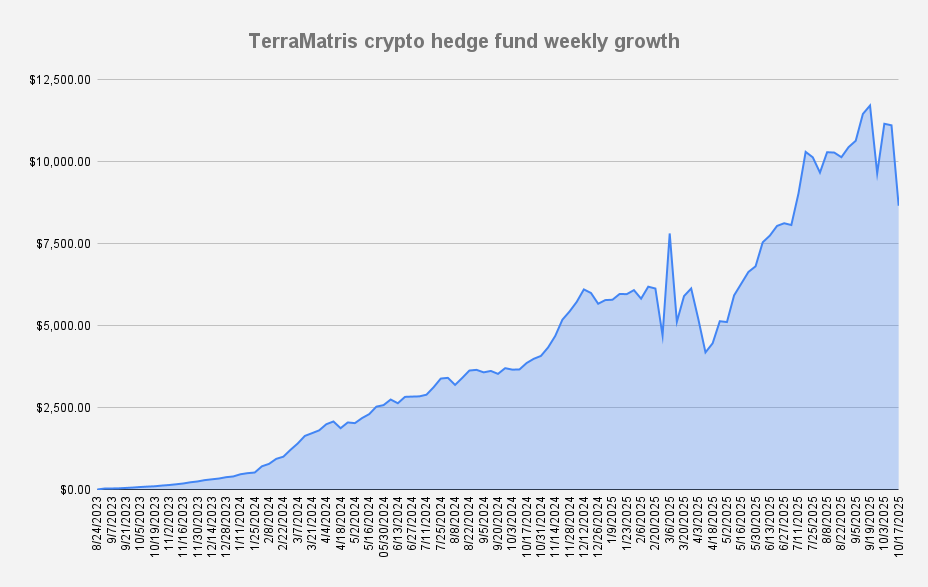

As of October 17, 2025, the TerraM Crypto Fund reported a net asset value of $8,661, representing another massive -22.08% decline from the previous week. This seems to be our biggest drawdown so far in 2025 — let’s hope it stays that way.

Wow, what a week — from the dramatic drop following last Friday’s announcement of a 100% tariff on China, to quickly recover by Monday, and then yet another decline even more harsh than last week.

As mentioned earlier, the crypto market has entered a rather choppy phase, and we are not excluding the possibility of further drawdowns. We believe the situation may worsen before it improves.

Since the fund is heavily reliant on ETH, we expect its price to decline to around $3,151 (the lower 50/200-day moving average), with a possible further drop to $2,537 if the market turns extremely bearish. However, we believe we are now better prepared and adjusted to navigate these conditions.

From the previous all time high we are down -26.09% , while YTD funds value has been at 52.49%.

Options Income

We sell weekly options every Friday, which is why this update is published at the end of the week.

This week, in total, TerraM fund earned $277 from options premiums, translating to a 3.19% weekly return on capital. As our target is anything above 1%, we're more than satisfied with this result.

For October, we’ve set a baseline target of at least $165 per week in options premium, and so far the plan is performing well. We’re genuinely astonished to have cracked $200 for the third row in a week in a regular week without the usual month-end boost.

Trades in Adjustment (USDT Settled / Weekly)

- 1.43 ETH – Break-even: $4,333 | long calls $4,100 (0.93), $4,200 (0.4) and short put: $3,800 (0.1)

- 13 SOL – Break-even: $215.29 | long calls: $205

- 0.02 BTC - Break-even: $116,225 | long calls: $117,000

Last week was a complete mess for our options trades in adjustment — we took most of our short puts as assignments, converting them into long perpetual futures positions and sold covered calls on them

Long positions

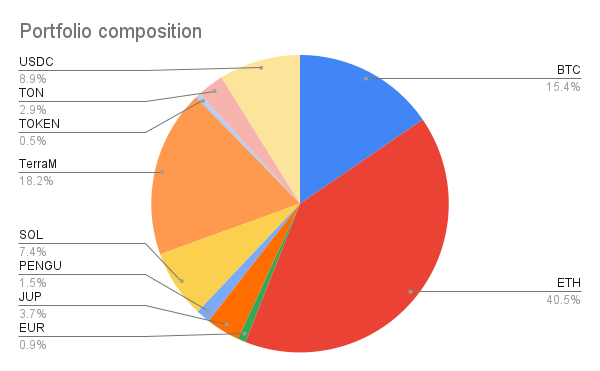

One of our short-term goals is to build long positions in BTC, ETH, and SOL — specifically to hold 1 ETH, 0.02 BTC, and 5 SOL. As of today, our current holdings stand at 0.86 ETH, 0.01 BTC, and 3.01 SOL. We expect to reach the 1 ETH target within the next few weeks.

Once these targets are achieved, our plan is to maintain these core positions permanently and use them as the backbone for our covered call strategy. Additionally, we aim for these three major cryptocurrencies to represent approximately 75% of the total portfolio (currently 62.21%).

To support this objective, we will temporarily pause our “moonshot” investments until we reach our short-term strategic goals, which we expect to complete by the end of the year.

TerraM token

Despite volatility in the broader crypto markets, the TerraM token remained stable — with no significant buys or sells. This stability reflects the fact that most TerraM holders are long-term investors. As a DeFi project, the limited activity in new purchases is also understandable. We do not anticipate any significant price appreciation until our fund’s value reaches $12,000, at which point we plan to initiate treasury operations.

- Solana blockchain

- Fully Diluted Market cap: $31,300

- Total supply: 10,000

- In circulation: 1,932 (19.33%)

- On Liquidity pool: 481 (4.81%)

- Price per token: $3.13

Solana Covered Call Growth fund

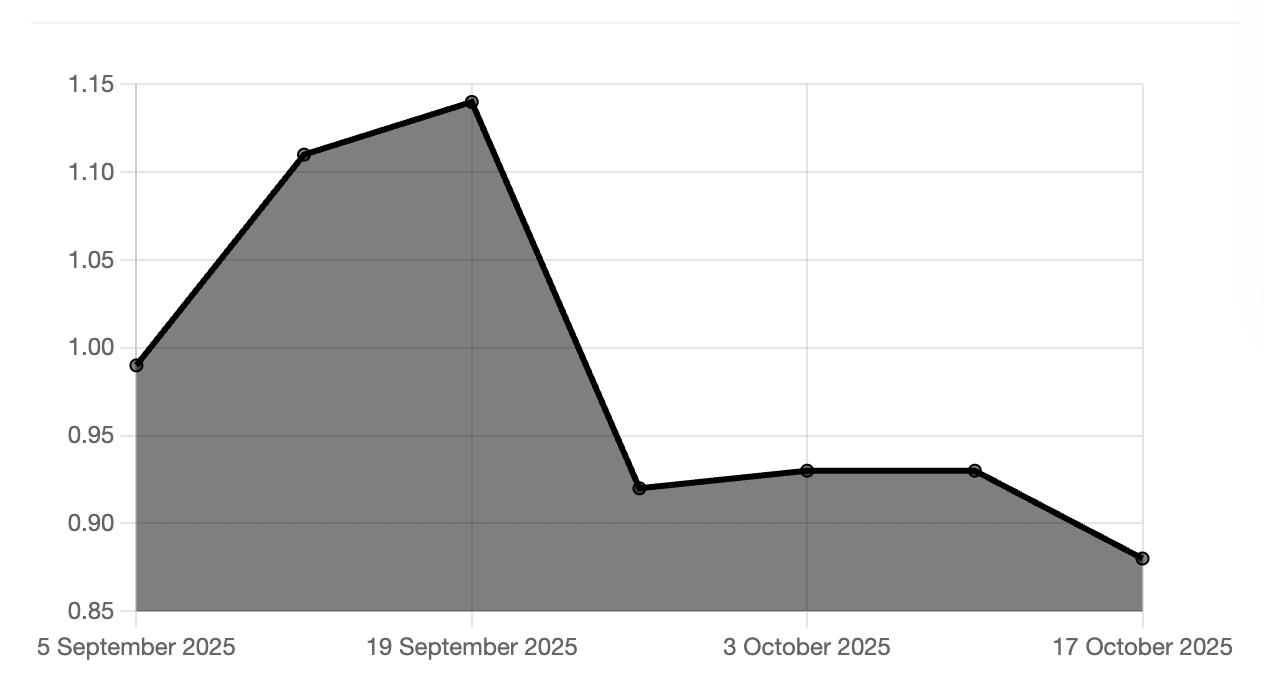

Our recently launched Solana Covered Call Growth Fund NAV (per unit) dropped to $0.86 while the biggest event of the week was securing an additional $5,000 investment into the fund, which brought its total value above $10,000 for the first time.

With the newly injected capital, we decided to take a slightly more aggressive position by purchasing 10 SOL and executing a classic buy/write strategy — selling covered call options expiring next week.

We also took assignment of 8 SOL tokens at a buy price of $210 each

Last week, fund generated $93.43 in options premiums, which equates to a 0.91% return on capital. This is slightly below our 1% weekly target, but considering that the fund is still in its early stages, we are quite satisfied with the result.

All option premiums were reinvested into spot SOL, increasing the fund’s total holdings to 24.37 SOL at an average purchase price of $207.86 per SOL.

With more capital under management, we are considering raising the minimum investment ticket from $5,000 to $10,000, while keeping the fund open until it reaches a total value of $100,000.

What else is brewing:

In addition to our ongoing work in options trading and fund management, we’ve been analyzing market reactions to tariff announcements, noted the surprise launch of XRP options on Bybit, and tracked several other notable developments.

- How Crypto Reacts to U.S. Tariff Announcements — and Why It Hurts More Than Stocks

- Bybit to Launch XRP Options — A New Opportunity Ahead

Disclaimer: This communication is strictly confidential and intended solely for its designated recipients. It is not for public distribution, reproduction, or forwarding. The information contained herein does not constitute investment advice and is provided for informational purposes only. Participation is restricted, and this material is not directed at or intended for distribution to citizens or residents of the United States.