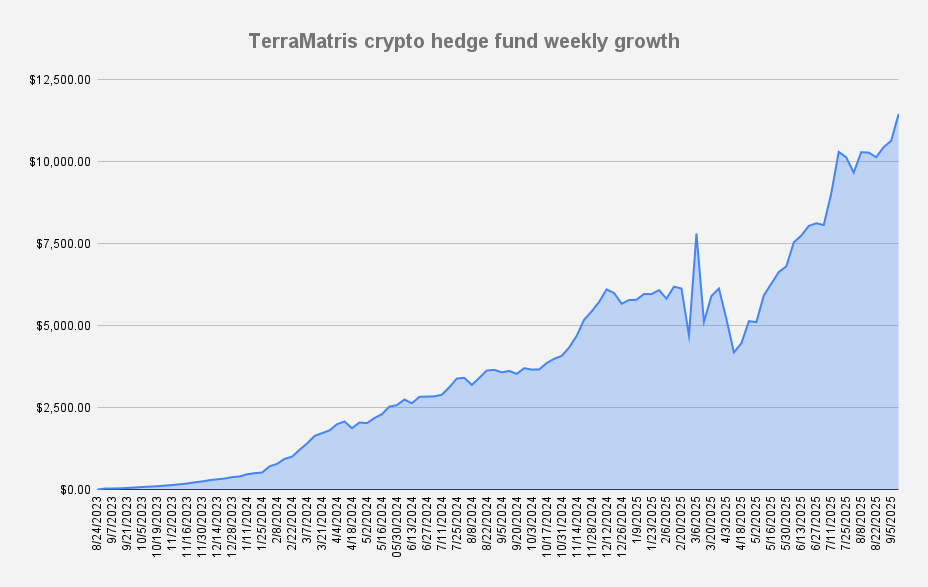

As of September 12, 2025, the Terramatris crypto hedge fund value stood at $11,461 what is an increase of +7.69% or +$818 in dollar terms when compared to the last week. Absolutely brilliant!

The week turned out better than expected, with bold moves - particularly in Solana. Most cryptocurrencies are trending higher, and to our surprise, the small position we began building in Plume just a few weeks ago is already up 40%.

As put sellers, we remain cautious, while maintaining an opportunistic outlook.

YTD our crypto hedge fund is +101.79%. Absolutely remarkable - we’ve doubled the fund’s size in less than nine months. If the yearly pattern holds, we may be at the beginning of a run heading into Q4 2025. That said, we remain grounded and cautious.

Options Income

We sell weekly options every Friday, which is why this update is published at the end of the week.

This week, in total, we earned $172 from options premiums, translating to a 1.5% weekly return on capital. Our target is anything above 1%, so we're satisfied with this result.

Looking ahead, we do not expect to exceed $200 per week in options premiums until the final week of September. For now, we have set a baseline target of $150 per week throughout the month.

Trades in Adjustment (USDT Settled / Weekly)

- 1.6 ETH – Break-even: $4,641 | Short puts: $4,200

- 13 SOL – Break-even: $225.07 | short puts: $218

This week, we adopted a slightly more aggressive approach with ETH puts, and there is a chance we may need to adjust the position next week.

TerraM token

As our fund crossed the $11,000 milestone, and in line with our 2025–2026 Buyback and Liquidity Plan, we increased liquidity by staking an additional 200 USDC, fully backed by 61 TerraM. This brought the total token count in the liquidity pool to 471 TerraM, which in turn helped reduce slippage by a few percentage points.

- Solana blockchain

- Fully Diluted Market cap: $32,600

- Total supply: 10,000

- In circulation: 1,933 (19.33%)

- On Liquidity pool: 471 (4.71%)

- Price per token: $3.26

- Slippage per 200 TerraM tokens (-29.35%)

*The biggest challenge we are currently facing with the TerraM token is slippage. Due to the shallow depth of the liquidity pool, slippage remains significant — for example, converting 200 TerraM back to USDC would currently incur a loss of -29.35%. We expect to reduce slippage by additional few percentage points once the fund’s value surpasses $12,000.

Solana Covered Call Growth fund

Our Solana Covered Call Growth Fund has delivered a strong start. After the first week, the fund’s NAV increased by 11%, rising from $1.00 to $1.11.

The fund’s strategy focuses on generating option premium income by selling covered calls on Solana, utilizing both spot holdings and futures for selective leverage. Unlike traditional income-focused funds, we are not distributing yield at this stage. Instead, our priority is to grow the underlying Solana spot position steadily over time.

Currently, TerraM is the sole investor in the fund, contributing small bi-weekly allocations (funded from options premiums) Over the next 12 months, we are targeting an aggregate investment equivalent to 26 SOL tokens.

Accredited investors are invited to explore opportunities to participate, with a minimum investment of $5,000 (management fee 2% + 20% performance fee)

Disclaimer: This communication is strictly confidential and intended solely for its designated recipients. It is not for public distribution, reproduction, or forwarding. The information contained herein does not constitute investment advice and is provided for informational purposes only. Participation is restricted, and this material is not directed at or intended for distribution to citizens or residents of the United States.