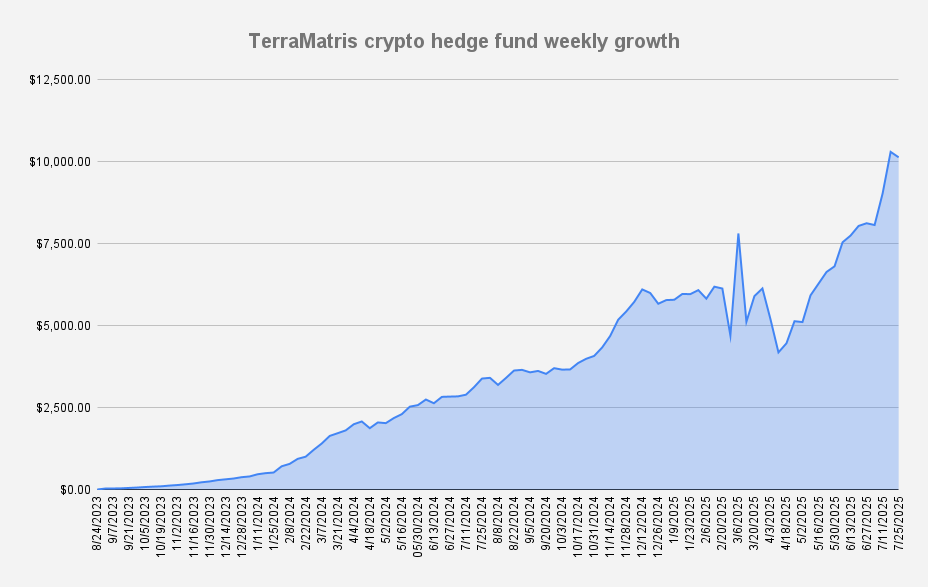

As of July 25, 2025, the Terramatris crypto hedge fund value was $10,138 what is a slight decrease of -1.61% or -$166 in dollar terms when compared to the last week. A healthy pullback after few strong weeks. YTD our crypto hedge fund is +78.50%. Awesome!

Current Long Perpetual Futures (USDT Settled)

- 0.02 BTC – Break-even: $125,277 | Short puts: $109,000

- 1.7 ETH – Break-even: $3,448 | Short puts: $3,300

- 5 SOL – Break-even: $173.87 | short puts: $170

We sell weekly options every Friday, which is why this update is published at the end of the week.

This week, in total, we earned $418 from options premiums, translating to a 4.12% weekly return on capital. Our target is anything above 1%, so we're satisfied with this result.

This has been our best-performing week so far in terms of yield and options premium.

To be precise, the surge was driven by the rollout of monthly expiry options. We consistently observe a premium boost at the end of each month as we simultaneously roll forward both weekly and monthly positions.

Looking ahead, we don’t anticipate generating more than $200 per week in premiums through the end of August, barring any major volatility spikes or strategy changes.

TerraM Token Update

After a successful buyback last week, our native TerraM token increased to $3.01, which is an increase of 13 cents and marks an all-time high.

- Solana blockchain

- Fully Diluted Market cap: $30,100

- Total supply: 10,000

- In circulation: 1,640 (16.4%)

- On Liquidity pool: 377 (3.77%)

- Price per token: $3.01 | Swap on Raydium, ByBit or OKX.com (Solana supported wallet required)

In the coming weeks, we’re planning to inject more liquidity and initiate a token buyback to support the ecosystem.

Thank you for being part of this journey!

This update is for informational purposes only and should not be considered financial advice. Always do your own research before making investment decisions