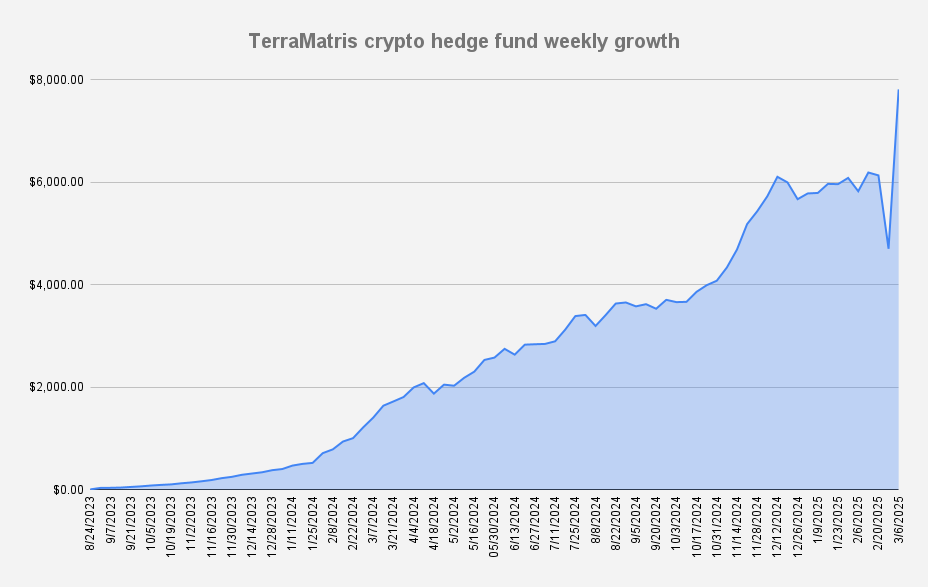

As of March 6, 2025, the Terramatris crypto hedge fund's value has increased to $7,814, reflecting a significant +66.17% growth week over week. This growth follows a strategic step to stabilize our portfolio by adding over $4,400 in capital after last week’s crypto market sell-off.

The past week has been marked by heightened volatility across the crypto space. Bitcoin and Ethereum have continued their downward trend amid broader economic uncertainty. A key factor driving market sentiment has been renewed geopolitical tensions, with President Trump escalating trade wars, causing ripple effects across global markets. Additionally, the launch of a strategic crypto reserve by United States has drawn attention, signaling long-term confidence in the digital asset space despite short-term bearish conditions.

Portfolio Adjustments

This week, we took a strategic step to stabilize our portfolio by adding over $4,400 in capital. The funds were secured with an agreed repayment plan over 10-12 months, committing to a structured payback of $400 per month. This financial responsibility underscores our disciplined approach to portfolio management, ensuring the funds are used for stability rather than excessive leverage.

Given the current bear market conditions (for the Ethereum part at least), our trading strategy remains defensive. We are not opening new put trades at this time. Instead, we are focusing on selling covered calls on our existing positions and managing our put options portfolio effectively.

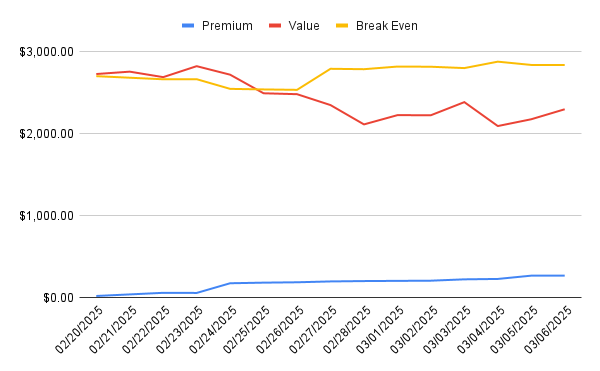

A significant portfolio adjustment was the conversion of most deep in-the-money put options into long perpetual futures contracts. This move allows us to manage risk while maintaining exposure to potential market recoveries. To mitigate potential losses and improve our cash flow, we are actively selling covered calls against these positions to at least break even.

Currently holding 1.1 long ETH perpetual futures contracts with a break-even price at $2,841. As of writting this article ETH price was $2,300, meaning we were losing -$541 per ETH.

TerraM Token Update

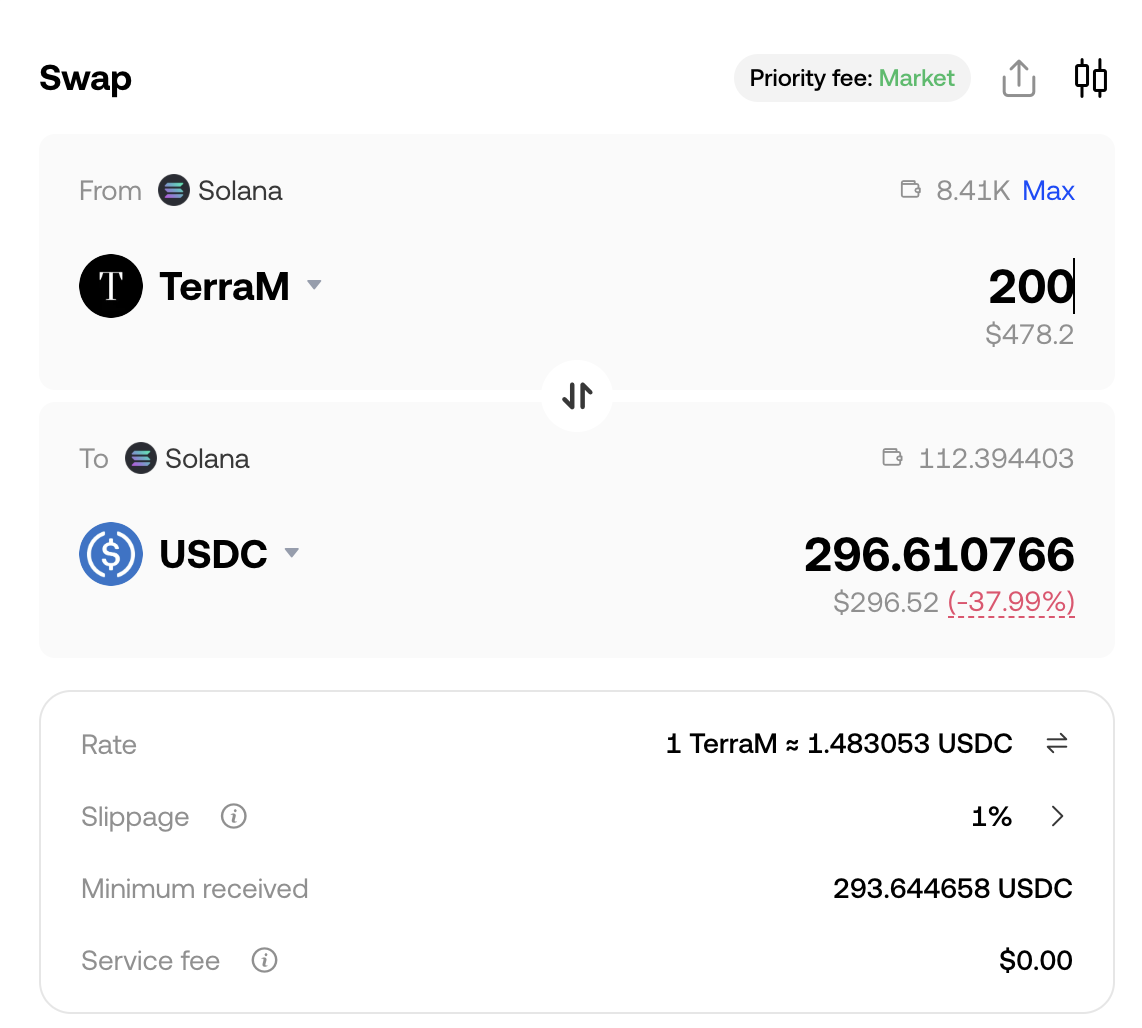

This week, the price of the TerraM token has increased to $2.45 following a successful buyback, which contributed to positive market sentiment and growing investor interest.

Additionally, we have managed to improve liquidity slightly. However, slippage remains significant, and we are actively working on measures to reduce it to ensure a more stable trading environment for investors.

Current slippage for exchanging 200 TerraM tokens to USDC is -37.99%, which is slight improvement if compared to the previous week. We look to bring slippage down for a few percentage points also next week.

Our priority remains prudent risk management and capital preservation. The ongoing trade wars and macroeconomic uncertainty will likely continue to impact crypto prices. However, the emergence of strategic crypto funds and institutional interest reinforces the long-term viability of digital assets. By maintaining a disciplined approach, we aim to navigate the bear market effectively while positioning ourselves for future opportunities.

Disclaimer: This update is for informational purposes only and should not be considered financial advice. Please conduct your own research before making any investment decisions.