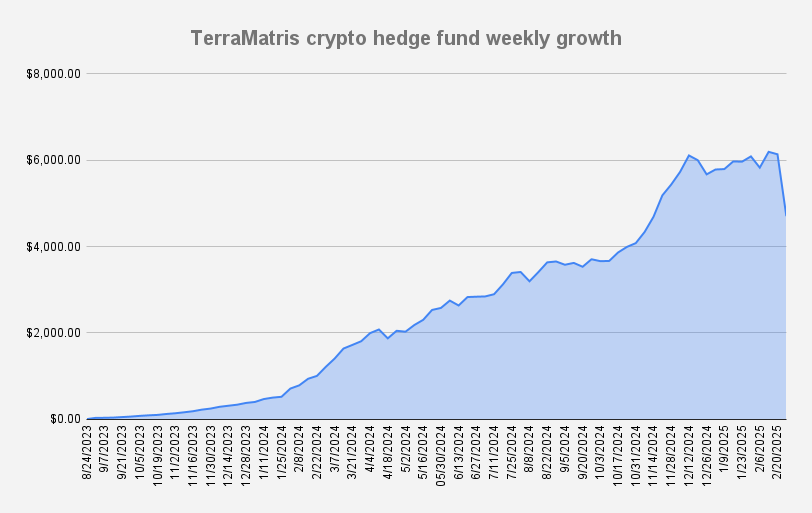

As of February 27, 2025, the Terramatris crypto hedge fund's value has decreased to $4,702, dropping -24% week over week following Bitcoin’s drop below $85,000 this week. This downturn triggered a sharp selloff in altcoins, amplifying losses across our portfolio.

The decline was further exacerbated by our short put positions on Ethereum with $3,500 strikes, which resulted in additional losses. Nevertheless, we remain optimistic and focused on long-term strategic positioning.

Current Holdings and Strategy

This past week, we continued our passive income strategy, collecting options premiums through covered calls. Our long holdings include approximately 0.75 ETH, 0.01 BTC, and about 3 SOL, which serve as collateral for our call-selling strategy. Additionally, we are holding 1.8 in-the-money short ETH puts with expiries on Feb 28, Mar 28, June 28, and September 26. These positions have kept us more defensive over the past few weeks, limiting active trading adjustments.

Options Positions:

Short

- 0.1 ETH $3,500 Feb 28, 2025

- 0.2 ETH $3,400 Mar 28, 2025

- 0.2 ETH $3,200 Jun 27, 2025

- 0.2 ETH $2,800 Jun 27, 2025

- 1 ETH $2,500 Sep 26, 2025

In total, we are holding 1.7 short ETH put options with different strikes and expiries. We opened an additional 1 short ETH with September 28 expiry to adjust a few of our deep in-the-money options trades expiring in February and March.

Covered Calls

- 0.2 ETH $3,000 Feb 28, 2025

- 0.8 ETH $3,600 Feb 28, 2025

- 0.02 BTC $113,000 Feb 28, 2025

- 2 SOL $236 Feb 28, 2025

- 1 SOL $290 Feb 28, 2025

All of our long holdings will most likely expire worthless. Our next move will be to roll into March 28 covered calls, unfortunately, after the market crash, the premiums will not be as lucrative. However, that is part of the options game. With current market prices, we are looking at about $100 in options premium from new covered call positions.

Market Outlook

Bitcoin has fallen sharply, now trading below $85,000, raising concerns about further downside. If weakness persists, we anticipate a possible retest of the $80,000 support level. In a deeper selloff scenario, Bitcoin could see lows of $68,000.

Ethereum, already trading below its 200-day moving average, presents an opportunity for establishing a long position. Given Ethereum’s fundamental strength, we see potential for a price recovery, which we plan to navigate through a covered call strategy.

TerraM Token Update

The TerraM token remains stable at $2.26-2.3 despite broader market declines. However, liquidity conditions continue to pose challenges, with notable slippage during larger transactions

Despite recent setbacks, our strategy remains unchanged: managing risk while capitalizing on market opportunities. We will continue refining our positions to navigate volatility while seeking sustainable long-term growth.

Wyoming Incorporation

We are studying our options to incorporate the Terramatris crypto hedge fund in Wyoming, US. This comes with some rules and restrictions on how we can run our fund. There are pros and cons with Wyoming, and alternatively, we are considering other jurisdictions like Dubai. However, we are 95% likely to proceed with a US legal formation at this stage. The projected time frame for incorporation is set around the second half of 2025.

Disclaimer: This update is for informational purposes only and should not be considered financial advice. Please conduct your own research before making any investment decisions.