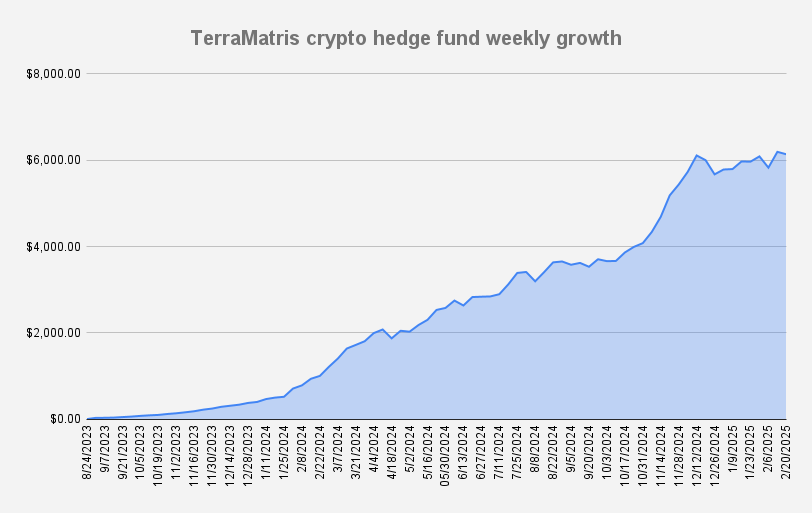

As of February 20, 2025, the Terramatris crypto hedge fund's value stands at $6,135, reflecting a slight decrease of -0.91% compared to the previous week. Year-to-date, our fund's value has grown by 8.03%.

This past week, we maintained our current passive strategy, collecting options premiums through covered calls. Our long holdings include approximately 0.75 ETH, 0.01 BTC, and about 3 SOL, all of which are utilized for call selling. Additionally, we are currently holding 0.8 in-the-money short ETH with different expiries (Feb 28, Mar 28, and June 28), which is the reason we have been more passive in the past few weeks/months.

Looking ahead, for the next 10 weeks, we are considering buying 1 long ETH perpetual futures contract while simultaneously selling weekly calls against it. This approach could increase our overall risk exposure, but we remain confident in our ability to manage it effectively.

Unlike Bitcoin, Ethereum has already fallen below its 200-day moving average, presenting what we believe to be an attractive entry point for establishing a long position. Given Ethereum’s strong fundamentals and potential for significant upside, we see this as an opportunity to capitalize on price recovery while managing risk through a covered call strategy.

Market Outlook

Bitcoin is currently trading slightly above $97,000, positioned between its 50-day and 200-day moving averages. Resistance remains at $99,000, and while a breakout to new record highs is possible, we are cautious about the potential for a correction. Before moving higher, Bitcoin could first test support around $80,000. In a more bearish scenario, an extreme selloff could push prices as low as $68,000.

TerraM Token Update

The TerraM token remains stable at $2.30. However, liquidity conditions remain challenging, with significant slippage still present.

Swap USDC/TerraM on Raydium, OKX, and other Web3 wallets that support Solana.

With our fund maintaining stability despite minor fluctuations, we remain committed to prudent risk management. Our focus is on maximizing growth through a strategic blend of covered call selling and potentially increasing our exposure via ETH perpetual contracts.

Disclaimer: This update is for informational purposes only and should not be considered financial advice. Please conduct your own research before making any investment decisions.