How Crypto Reacts to U.S. Tariff Announcements — and Why It Hurts More Than Stocks

| Research | 54 seen

When the U.S. government announces new tariffs, markets panic, and crypto tends to take the hardest hit.

We’ve seen this pattern repeatedly: a single policy shock sends stocks tumbling, bonds rallying, and Bitcoin plunging twice as hard. But why does a trade policy aimed at physical goods ripple so violently through digital assets? And how long does it usually take for crypto to recover?

Let’s break down the dynamics, the psychology, and what we’ve observed firsthand in our own portfolio after major tariff shocks.

The Immediate Reaction: Panic, Liquidations, and Correlation

Tariff announcements are not just about economics — they’re about uncertainty.

The moment new import taxes or trade restrictions are declared, global investors shift into “risk-off” mode. Equities fall, the dollar spikes, and liquidity evaporates across speculative assets.

Crypto, unfortunately, sits at the very edge of that spectrum.

Within hours of such announcements:

- Bitcoin and Ethereum typically drop 2–3× more than the S&P 500.

- Open interest on futures markets collapses.

- Billions in leveraged long positions are liquidated.

- Volatility (realized and implied) explodes.

In our experience at Terramatris, the portfolio often suffers its sharpest daily drawdowns during tariff headlines — even though the crypto market has no direct link to steel, cars, or semiconductors.

This is purely a sentiment correlation effect: when traditional traders de-risk, they sell everything with volatility attached — and crypto is at the top of that list.

Why Crypto Reacts to Trade Policy at All

There are three main mechanisms behind this correlation:

Risk sentiment transfer

Crypto now trades as a global risk asset. Institutional money, macro funds, and retail traders all treat Bitcoin and Ethereum as high-beta plays on liquidity and optimism. When tariff news signals slower growth or global uncertainty, those positions are first to go.

Liquidity chain effect

Margin calls and equity losses force fund managers to raise cash elsewhere. Crypto holdings — especially on regulated platforms — are often liquidated to meet collateral needs.

Narrative contagion

Even if tariffs don’t touch crypto directly, the macro narrative shifts from “expansion” to “recession risk.” That shift compresses valuations across all risk assets. Algorithms trading cross-asset correlations simply follow the flow.

How Long It Usually Takes to Recover

Looking at previous episodes (2018 China tariffs, 2019 escalation, and smaller tariff scares since), crypto tends to follow a three-phase recovery pattern:

Shock & liquidation

1–3 days

Sharp 10–20 % drops, high funding rates reset, huge volumes

Relief rebound

3–10 days

Oversold bounce, short-covering, funding normalizes

Consolidation & rebuild

2–4 weeks

Range trading before resuming trend, often faster than equities

On average, major tariff-induced crypto crashes take about 2–4 weeks to fully recover, assuming no new escalation.

If tariffs deepen or retaliation follows, recovery can stretch to 6–8 weeks.

Interestingly, crypto often leads the recovery phase — once fear subsides, liquidity returns faster to Bitcoin than to equities. But timing it requires patience and strict risk control.

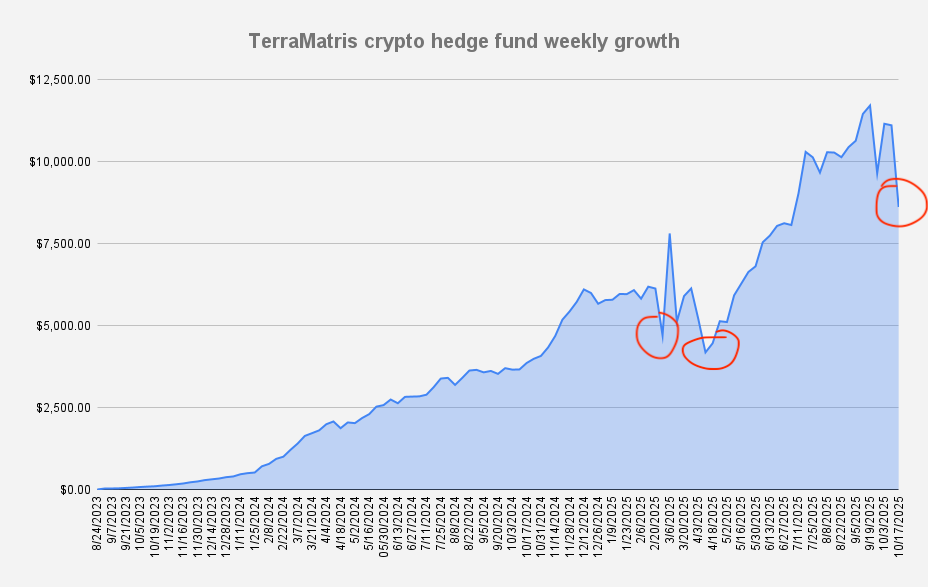

Our Experience: The March–April Drawdown and September Rebound

At Terramatris, we experienced a massive portfolio drop during the March–April 2025 correction, triggered by tariff fears and broader macro stress.

The portfolio lost a significant portion of value within days as leveraged long positions across exchanges were liquidated.

However, by staying disciplined — cutting leverage, keeping exposure manageable, and gradually rebuilding — the market fully recovered and went on to reach new all-time highs by September 2025.

That rebound reinforced a critical lesson:

Leverage is the biggest enemy during macro shocks.

Crypto’s volatility is already extreme; adding borrowed exposure magnifies losses exponentially.

Avoiding leverage — or using it sparingly and strategically — is the single best defense against panic-driven wipeouts.

Why Recovery Sometimes Doesn’t Come Quickly

There are reasons recovery may stall or fail entirely:

- Persistent macro fear: If tariffs escalate into a prolonged trade war, investor appetite for high-volatility assets stays low.

- Tight monetary policy: When interest rates remain high, liquidity to fuel speculative rallies dries up.

- Sentiment damage: Multiple shocks in a short period (tariffs + regulation + earnings misses) can exhaust dip buyers.

- Structural leverage wipeouts: After extreme liquidation events, traders need time to rebuild collateral and confidence.

In those cases, the crypto market may move sideways for months even if prices don’t collapse further.

Our Broader Takeaways

Through multiple tariff cycles, we’ve learned three rules that consistently protect capital:

- Keep leverage near zero when macro risk rises.

- Use volatility spikes to sell options or reposition, not to chase price.

- Expect crypto to bottom before equities — but only after forced liquidations clear.

These principles helped us navigate the March–April drawdown and come out stronger in September.

The Takeaway

Tariff announcements are a reminder that crypto is no longer an isolated niche — it’s part of the global macro risk web.

When traditional markets fear slower trade and tighter liquidity, Bitcoin bleeds with the rest of them.

But unlike industrial stocks, crypto tends to snap back faster, provided the policy shock fades instead of festers.

In other words:

“Tariffs don’t target crypto — but crypto still takes the bullet.”

For disciplined investors, that’s both a warning and an opportunity.

When the panic hits, manage risk. When the dust settles, be ready , because crypto rarely stays down for long.

ASR Reward from JUP Makes Us Happy

| Investment ideas | 31 seen

Sometimes the crypto world brings pleasant surprises — and this week, JUP Network did exactly that for us at Terramatris.

Back in January 2024, JUP tokens unexpectedly landed in our portfolio as part of a surprise airdrop. At the time, we didn’t have any specific stance on the project — we weren’t particularly bullish or bearish.

Jupiter (JUP): Why This Solana DeFi Token Caught Our Attention

We decided to allocate a small portion of our fund to JUP, categorizing it in our “moonshot sector” - assets that we’d be thrilled to see appreciate 10x–100x in a meaningful time frame but are also ready to accept could go to zero. JUP fit perfectly into that high-risk, high-upside segment of our portfolio.

Instead of letting the tokens sit idle, we continued dollar-cost averaging into JUP over time. The tokens we accumulated are staked, and we also participate in the Jupiter DAO, engaging with governance and network updates.

These are not core trading activities for our fund — rather, they represent our contemplative, experimental side, exploring promising ecosystems without risking too much capital.

One of JUP’s most interesting mechanics is its ASR (Active Staking Rewards) system, which distributes rewards once per quarter. We’ve just received our latest round — an estimated 2% in additional tokens and while that might not sound huge, it’s a solid and consistent return for an otherwise passive position.

In a market where many assets promise much but deliver little, these ASR rewards are a reminder that steady participation pays off — even if the total exposure is small.

We don’t see JUP as a pillar of the Terramatris portfolio, but rather as a speculative satellite, orbiting around our more strategic investments. Still, when surprises like this ASR reward arrive, they make us smile and keep us curious about what’s next for the Jupiter ecosystem.

Georgian Tax Residency: A Strategic Option for HNWIs and Crypto Individuals

| Research | 73 seen

At Terramatris, we examine how funds and financial structures work across different jurisdictions. We don’t provide legal or tax advice, but we do explore how certain models stand out in the global landscape. One of the most compelling examples today is Georgia’s tax residency framework, which offers particular advantages to high-net-worth individuals (HNWIs) and crypto investors.

What Is Georgian Tax Residency?

The most common path is the 183-day rule:

- If you spend at least 183 days in Georgia during a rolling 12-month period, you qualify as a tax resident.

There is also a High Net Worth Individual (HNWI) track, where residency can be granted even without the 183 days, provided you can demonstrate certain global income or asset thresholds. This makes Georgia appealing to internationally mobile individuals who do not want to tie themselves down geographically.

The Georgian Revenue Service issues a tax residency certificate, which is critical for establishing Georgia as your tax home in the eyes of other jurisdictions.

Why It Matters for Individuals

Territorial Taxation

Georgia taxes only Georgian-sourced income. For HNWIs and crypto holders whose wealth is generated abroad (for example, from trading on international exchanges), this can dramatically reduce tax burdens.

Crypto-Friendly Environment

Georgia has signaled openness toward digital assets. While regulations are evolving, the environment remains relatively light compared to more restrictive countries.

Flat and Simple Personal Taxes

Georgian-sourced income is taxed at a flat 20%, while certain statuses (such as small business regime) can lower effective taxation significantly. For individuals with mixed income streams, the simplicity is attractive.

Wealth Protection & Lifestyle

Residency in Georgia offers more than taxes: low cost of living, access to banking, and a strategic location between Europe and Asia. For individuals seeking to diversify lifestyle and financial risk, this creates added resilience.

Potential Downsides to Consider

No jurisdiction is perfect. Before considering Georgian tax residency, individuals should be aware of the following limitations:

Changing Regulations

Georgia is still shaping its crypto policy and broader financial regulations. What looks advantageous today may be revised in the future as global standards tighten.

Perception of Tax Residency

Other countries may not automatically recognize Georgia as your main tax base if you maintain strong ties elsewhere (property, family, business). This can lead to dual-taxation disputes, especially with more aggressive tax authorities.

Banking & Financial Services

Although Georgia’s banking system is accessible, it is not as internationally integrated as Switzerland, Luxembourg, or Singapore. Large crypto-to-fiat transactions may attract scrutiny.

HNWI Track Limitations

Proving wealth or income for the HNWI residency track requires documentation and sometimes discretionary approval. It may not be as straightforward as the 183-day rule.

Reputation Risks

Some investors may view Georgia as an “emerging” jurisdiction rather than a fully established financial hub. This perception can matter when dealing with conservative institutions or international partners.

Relevance for Crypto Individuals

Unlike funds or firms — which we’ve discussed separately in our article on crypto fund structures and Georgia’s role — individual investors face different challenges. Residency and taxation directly impact how profits from trading, long-term holding, and portfolio rebalancing are treated.

For a crypto individual:

- Establishing Georgia as your primary tax residence can help avoid dual-taxation conflicts.

- Gains from foreign crypto trades may fall outside Georgian taxation under the territorial system.

- The HNWI track provides flexibility for those who prefer not to spend long periods in one country.

Important Caveat

As always, Terramatris emphasizes: we are not providing legal or tax advice. Each person must consult qualified advisors before acting. Our goal is to analyze global financial structures, and Georgia stands out as a particularly innovative jurisdiction for individuals navigating the complexities of crypto wealth.

For HNWIs and crypto individuals, Georgia offers a unique mix: territorial taxation, flexibility in residency options, and a crypto-friendly outlook. But with potential downsides — from regulatory changes to perception risks — careful planning is essential.

At Terramatris, we see the Georgian tax model as one of the most interesting cases globally, and one that deserves close attention from anyone serious about cross-border wealth and crypto management.

And for anyone going through the process, a great helper for tax document translations and notarization services is caucasustranslations.com.

Why Registering a Small Crypto Trading Firm in Georgia Makes Sense

| Research | 28 seen

The global crypto market is becoming more institutionalized, and even small proprietary trading firms need to think about jurisdiction, compliance, and taxation. While the U.S. (Wyoming, Delaware) and offshore hubs (BVI, Seychelles) remain popular, Georgia, the country in the Caucasus,has quietly emerged as an attractive option for crypto-friendly businesses.

Below, we’ll explore why Georgia might make sense for a small crypto trading firm, what the registration process looks like, and the pros and considerations you should keep in mind.

Why Georgia?

Crypto-friendly environment: Georgia does not have hostile legislation toward crypto. Trading, investing, and holding digital assets is not restricted for companies or individuals.

Low taxes: Georgia applies an Estonian-style corporate tax model — you only pay corporate tax (15%) when distributing profits as dividends. Reinvested earnings are tax-free. For small businesses, a turnover tax regime exists with just 1% tax on revenue if annual turnover is under GEL 500,000 (~USD 180,000).

Banking access: Unlike some offshore jurisdictions, Georgian banks (TBC, Bank of Georgia) are relatively open to fintech and international clients.

Ease of incorporation: An LLC can be registered in a few days. Remote registration is possible through a power of attorney.

Steps to Register a Trading Firm in Georgia

Incorporation

- File Articles of Association and register with the National Agency of Public Registry.

- Typical turnaround: 1–2 business days.

Tax ID & VAT Status

- Obtain a tax identification number.

- For small trading firms, VAT may not be required, but it depends on your turnover and activities.

Bank Account

- Open a corporate account at a Georgian bank (TBC, Bank of Georgia).

- Alternatively, apply to fintech solutions like Wise or Payoneer for global transfers.

Exchange Accounts (Corporate KYB)

- Exchanges like Bybit and Deribit allow corporate accounts.

- Provide incorporation docs, tax ID, and proof of ownership.

Compliance & Reporting

- Maintain accounting records.

- File annual reports; tax only applies when distributing profits.

Tax Advantages

Reinvestment Freedom: Retained earnings are tax-free until distributed. Perfect for proprietary firms reinvesting in crypto.

Small Business Regime: Under GEL 500,000 turnover, pay 1% turnover tax instead of standard rates.

Dividend Withholding Tax: When distributing profits, an additional 5% applies, making the effective tax burden about 20% — still competitive globally.

Considerations and Challenges

Enhanced banking oversight: Financial institutions in Georgia, like in many jurisdictions, apply rigorous due diligence for companies engaged in digital assets. Firms should be prepared to provide clear documentation and transparency in operations.

Evolving regulatory framework: While crypto activity is currently accommodated within existing structures, digital asset regulation worldwide continues to develop. Firms should anticipate potential adjustments and align with international compliance standards.

Operational requirements: Maintaining proper accounting, local reporting, and engaging qualified advisors is essential for full compliance and efficient tax planning.

For a small proprietary crypto trading firm, Georgia offers a combination of low taxation, ease of registration, and access to international banking that few jurisdictions can match. It is particularly compelling for firms reinvesting profits into spot crypto rather than distributing dividends frequently.

Important Note: We are not offering legal, tax, or incorporation services in Georgia. This article is for informational purposes only. However, if you are considering setting up a small trading firm and would like to have a meaningful conversation about structuring, strategy, and practical experiences, we would be open to a discussion.

Discovering Derive: Our First Steps into True DEX Options Trading

| Research | 28 seen

At Terramatris, we’ve always been fascinated by the evolution of crypto markets and the growing range of opportunities they create for traders and investors. For years, our main focus has been on more traditional centralized exchanges (CEX) such as Bybit and Deribit. These platforms have provided liquidity, stability, and advanced trading features—making them indispensable for our operations.

But one thing has always been missing: a true decentralized exchange (DEX) for options trading.

Recently, while researching potential institutional partners for our US operations (Kraken), we stumbled upon Derive, a DEX options trading platform. If liquidity and market makers keep growing, Derive has the potential to become a central piece in the future of decentralized derivatives trading.

Why Derive Matters

Decentralized trading isn’t just about ideology—it’s about resilience, accessibility, and innovation. While we still rely heavily on CEXs for their speed and liquidity, a truly functioning DEX fills a crucial gap. Derive does just that.

At the moment, Derive supports BTC and ETH options trading. Naturally, we would love to see Solana integrated in the future, especially since we’re actively running our Solana Covered Call Growth Fund. But even without Solana, having BTC and ETH live on a fully decentralized platform is an exciting step forward.

The fee structure is another point of interest. On first glance, trading fees seem higher compared to centralized competitors like Bybit or Deribit. However, Derive’s native token (DRV) plays an important role. Traders receive partial refunds in DRV, effectively cutting fees in half. For us, this means not only do we get exposure to a new instrument (DEX options), but we also add a new token to our portfolio. We see this as a learning opportunity, and we’re happy to take a small position as we continue exploring the ecosystem.

Who’s Behind Derive?

As we dug deeper, we learned that Derive is backed by the Lyra Foundation, a team known for pioneering decentralized derivatives. While our knowledge so far only scratches the surface, we feel increasingly confident about their vision and execution. It’s rare to find a DEX team that has both the technical expertise and the financial infrastructure to compete with established CEXs.

Our philosophy at Terramatris has always been simple: we like to put our money where our mouth is. That’s why, even at this early stage, we’re committing a small portion of our portfolio to Derive.

How It Works in Practice

Getting started on Derive was straightforward but requires some familiarity with DeFi tools. Here’s how we approached it:

- Wallet Setup – Derive connects through MetaMask, making onboarding seamless for anyone already using DeFi applications.

- Network Choice – We opted for the Arbitrum network, which offered us lower fees and reliable transaction speeds.

- Funding the Account – We deposited USDC and ETH into our wallet on Arbitrum, ensuring we had both stable collateral and trading capital.

- First Trade – To test the waters, we opened a 0.1 ETH put contract. This small initial trade is our way of learning the platform mechanics while limiting risk exposure.

So far, the process has been smooth, and the interface feels intuitive compared to other DEX platforms we’ve tested in the past.

Our First Impressions

- Accessibility: The MetaMask integration is seamless, making it easy for anyone with a Web3 wallet to get started.

- Transparency: No KYC requirements keep the platform true to the spirit of DeFi. But that might be challenging in the future.

- Innovation: The DRV token and fee refund system provide an interesting incentive model, even if it’s something we’re still learning about.

- Potential: If Derive manages to attract enough liquidity, it could become a serious competitor to the established CEXs.

For us, Derive represents more than just another trading platform—it’s a proof of concept that decentralized options trading can work. While we still rely on centralized exchanges for the majority of our trading activity, having a DEX option is something we’ve been waiting for.

We are genuinely excited about this development. Even though our current position is small, it feels like the beginning of something important. In the future, we would love to see Solana integrated, which would align perfectly with our existing strategies.

For now, Derive has already earned a spot in our portfolio and in our watchlist. It’s rare that we come across something that feels both innovative and practical—but Derive checks both boxes.

As always, we’ll continue to share our journey and learnings with our community. If you’re curious about decentralized options trading, we encourage you to give Derive a try—all you need is MetaMask and some ETH.

Why We Added Wormhole (W) to the TerraM Portfolio?

| Investment ideas | 45 seen

At Terramatris, our core strategy is straightforward: we focus on established assets like Bitcoin, Ethereum, and Solana, and we use them to generate a steady flow of options premium. That premium is what drives our consistency. It’s boring, it works, and it’s repeatable.

But there’s another side to our strategy. We also keep a sleeve of moonshot bets — small, speculative positions that could one day turn into something much larger. The logic is simple: in crypto, a single asymmetric bet can change the shape of the portfolio. We’re not reckless, but we are opportunistic.

How Wormhole Landed on Our Radar

We like to make the discovery process fun. Instead of pretending we can out-research every token ourselves, we let AI help us dig. (Thank you, ChatGPT.)

The process brought us to Wormhole (W), an interoperability protocol connecting more than 20 blockchains. Does it become the TCP/IP of crypto? Or does it get outcompeted? Honestly — we don’t know. That’s exactly why it fits in the moonshot sleeve.

Our belief in Wormhole is neutral. We don’t say “yes” or “no.” We just recognize the possibility that today’s small bet could become tomorrow’s big win — or fade into nothing. That’s the asymmetric tradeoff we’re looking for.

From Pengu to Wormhole

Earlier this year, we allocated to another speculative token — Pengu. After raising 5,000 Pengu in our portfolio, we decided it was time to rotate into a fresh opportunity. The replacement? Wormhole.

At current prices, we’re targeting an allocation of 2,000–3,000 W tokens in 2025 before reassessing. The sizing is intentionally small: enough to matter if it works, but never large enough to endanger the core fund.

Funding Arbitrage

We didn’t just buy spot W. To make things more interesting, we started with a funding fee trade:

- Buy spot W

- Sell perpetual W contracts

This simple arbitrage setup allows us to collect funding fees in the form of W itself. Today, those fees are tiny. But over time? Who knows. Maybe they turn into a meaningful kicker, maybe not. Either way, it’s a low-risk way to enhance the position while staying neutral on short-term price moves.

The Opportunistic Outlook

Our core remains BTC, ETH, and Solana — the proven majors that power the fund. They’re the workhorses generating the premium we rely on.

But we’ll continue to take small, opportunistic bets. Some will fail. Some may deliver 10x, 50x, or more. That’s the nature of moonshots.

Wormhole is simply the latest entry into this sleeve. It could be glue for a multi-chain crypto future, or just another protocol that fades. Either way, we’re in with eyes wide open, position size under control, and curiosity intact.

In short: Wormhole is not our conviction core holding. It’s a deliberate experiment — a small seed planted in 2025, left to see if it grows.

Why We Decided Not Yet to Tokenize Our Solana Covered Call Fund

| Research | 36 seen

When we launched the Solana Covered Call Growth fund, one of the exciting questions on the table was tokenization. The idea of creating a fully on-chain, tokenized representation of fund shares is appealing: transparency, liquidity, and a modern Web3-native structure. However, after careful consideration, we decided not to tokenize—at least not yet.

We are still in the early stages of building and refining this strategy. At this stage, our focus is on performance, repeatability, and reporting, rather than infrastructure. Tokenization can add a layer of complexity—both technical and regulatory—that distracts from the main goal: executing our options strategy consistently and profitably.

We did explore how tokenization could work in practice. For example, we spent several hours testing with Squads, one of the best DAO and treasury tools on Solana. The experience confirmed that while the tech is powerful, it also requires commitment to developer resources, maintenance, and onboarding—all of which might be premature for us.

Instead of rushing into tokenization, we decided to stick with a more traditional approach for now:

- Personal, direct NAV reporting to our investors.

- Simple and clear communication about fund performance.

- Avoiding overhead and not burning resources on developer teams.

This also aligns with our lean early-stage philosophy: we want to deploy capital efficiently, not on infrastructure we may not yet need.

What excites us is that we can already operate efficiently and transparently without heavy dev costs. Tools like ChatGPT help us with reporting, automation, and investor communication. This allows us to move fast, keep costs low, and focus on strategy execution.

Our decision is not a rejection of tokenization. We see clear benefits in the long run, and tokenization will likely play a role in the future of this fund. But timing matters. For now, we’re confident that a personal, streamlined, and cost-effective approach best serves our investors.

In short: we chose to walk before we run. Tokenization remains on the horizon, but today our energy is better spent on building trust, delivering returns, and refining our core process.

Delta-Neutral Arbitrage in Crypto: Inside Terramatris Solana Strategy

| Research | 34 seen

At Terramatris, we are still an early-stage crypto hedge fund. Our core strategy leans toward directional exposure—going long on assets we believe in and applying quantitative options strategies to generate income. Specifically, we sell puts and calls on assets like Ethereum and Solana, capturing option premiums while managing risk.

This allows us to grow the fund more aggressively, as we participate directly in upside movements while securing steady cash flow from option sales.

However, as outside capital gradually flows into the fund, we are also introducing arbitrage strategies alongside our directional and options trades. These arbitrage trades are not designed to rapidly grow a small fund, but they add balance, protection, and consistency to our overall portfolio.

Why Arbitrage Matters

Arbitrage trades offer a delta-neutral position, meaning the overall market direction doesn’t affect the outcome. Instead, returns are locked in by capturing spreads between different markets or instruments. While these trades may seem modest in terms of short-term profit, they provide peace of mind and stability for investors who value risk-adjusted returns over volatility.

From a more classical investment perspective, arbitrage can be very lucrative. Some of our strategies—like those in Solana markets—can reach annualized yields of around 9%, which is a strong, consistent return profile compared to many traditional asset classes.

Our Preferred Arbitrage Trade: Solana Spot vs. Futures

One specific trade we enjoy is:

- Long spot SOL (holding Solana directly)

- Shorting Solana futures with a set expiry

This structure allows us to lock in the spread between spot and futures prices, effectively hedging away price movements while securing a predictable yield.

Such trades don’t move the needle much when working with small amounts of capital, but with larger inflows they become a reliable way to enhance the fund’s stability and protect against sharp market swings.

Where We Use These Trades

Currently, arbitrage plays an important role in our Solana Covered Call Growth Fund, where they complement both our long positions and our quantitative options strategies. Looking ahead, we may consider launching a dedicated arbitrage fund. However, that approach would be more capital-intensive—since arbitrage yields scale best with size—and at this stage, our focus is still on growing assets under management.

Conclusion

At Terramatris, we believe in combining growth-oriented directional trades, quantitative options strategies, and risk-managed arbitrage trades. This blended approach allows us to capture market upside while offering investors stability and reliable returns. As our fund grows, we expect arbitrage to play an even more prominent role, potentially shaping entire fund structures dedicated to such strategies.

Why We Decided to Invest in Liberland Dollar (LLD)

| Investment ideas | 63 seen

At Terramatris, we are always exploring opportunities that align with our values of innovation, independence, and forward-thinking. Sometimes, these discoveries come through structured research, and sometimes they appear unexpectedly. Our recent investment into Liberland Dollar (LLD) belongs to the second category — a pleasant surprise during our ongoing research into projects that combine crypto innovation with strong community values.

Over the past year, we’ve attended few crypto-related meetups and brunches in Tbilisi, Georgia, a city that has become a lively hub for blockchain conversations. At nearly every event, we’ve run into Samuela, an enthusiastic Czech representative of Liberland, who passionately shares updates about the micronation and its ambitions.

At one of our recent gatherings, Sam shared some updates about Liberland. While going through them, we discovered that Liberland has its own native token — the Liberland Dollar (LLD). That revelation was the spark that pushed us to take a closer look.

What is Liberland?

Liberland, officially known as the Free Republic of Liberland, is a self-proclaimed micronation founded in 2015 by Czech politician Vít Jedlička. It is located in a small piece of no man’s land between Croatia and Serbia, on the west bank of the Danube River.

This territory, historically unclaimed due to border disputes, became a unique opportunity for Liberland to establish itself as a symbol of freedom, minimal governance, and voluntary cooperation. While not officially recognized as a sovereign state by the UN, Liberland has built an active community of supporters worldwide, with ambassadors, representatives, and even its own crypto-driven economy.

The Liberland Dollar (LLD) is part of that vision. It reflects not only an attempt to build an alternative economic system but also a way for supporters to engage with Liberland’s ideals directly through decentralized finance.

At Terramatris, we don’t shy away from unconventional projects. We believe that innovation often comes from unexpected corners. What sold us on LLD was a combination of factors:

- Shared values: Liberland promotes freedom, independence, and voluntary participation — ideas that resonate with the principles of decentralized finance.

- Unexpected discovery: Learning about LLD firsthand from Sam was a reminder that the crypto world is full of hidden gems waiting to be explored.

- DEX availability: Finding out that LLD is already available on Raydium AMM, a Solana-based decentralized exchange, made us even more excited. A true DEX-first token aligns perfectly with our preference for decentralized investments.

This is not a capital-intensive investment for us. Instead, we see it as a supportive, fun, and value-sharing step. At this stage, our goal is to accumulate no less than 100 LLD tokens — a symbolic position that signals our support for Liberland’s vision while keeping exposure modest.

We believe in staying open to diverse projects, and while LLD may not become a cornerstone of our portfolio, it represents an important part of our ongoing research into alternative economies and governance models.

Liberland Dollar is more than just a token; it is a fascinating experiment in combining political ideals, territorial claims, and blockchain technology.

Sometimes the best investments are not measured only by financial return but also by the value of being part of a shared vision. With LLD, we’ve found exactly that.

Why We Launched Solana Covered Call Growth Fund

| Funds | 77 seen

On September 4, 2025, Terramatris LLC officially launched its Solana Covered Call Growth Fund, a specialized investment vehicle designed to combine the growth potential of Solana (SOL) with disciplined income generation through covered call strategies. The fund began with an initial seed investment of $100 from TerraM and a net asset value (NAV) of 1.00, setting the foundation for future expansion.

Economics Behind the Fund

The economic rationale of the fund is straightforward yet ambitious. By holding SOL tokens as the core asset, the fund is directly exposed to the appreciation potential of one of the fastest-growing blockchain ecosystems. At the same time, by systematically selling call options against these holdings, the fund generates additional yield, enhancing returns during periods of sideways or moderately bullish markets.

This dual-approach strategy allows us to:

- Capitalize on token growth while maintaining long exposure to SOL.

- Collect option premiums to generate cash flow and reduce volatility.

- Balance risk and reward in a way that reflects both traditional fund management and modern crypto-native strategies.

We classify the Solana Covered Call Growth Fund as a high-risk, high-reward investment, reflecting the volatility of digital assets combined with leveraged derivatives activity.

Fund Structure and NAV Framework

Unlike previous experimental funds at Terramatris, this initiative is structured as our first traditional private fund, operating on a private open model. NAV is calculated using widely accepted traditional investment fund methodologies, allowing investors to track performance transparently and consistently.

- NAV Launch Point: 1.00

- Structure: Private, open-ended fund

- Core Asset: Solana (SOL)

- Strategy: Long SOL exposure + covered call writing

- Investor Access: By invitation, with a minimum ticket size of $5,000

The fund is not designed for mass participation. Instead, we are positioning it as an exclusive growth product for a select circle of investors who understand both the opportunity and risks inherent in crypto markets.

Commitment and Capital Growth

While we are actively working to raise additional investment capital, Terramatris itself maintains skin in the game. Beginning September 2025 and continuing until at least September 2026, Terramatris LLC will commit to bi-weekly contributions of $100 into the fund, demonstrating confidence and alignment with investors.

For its own capital, Terramatris is employing a leveraged x2 approach, amplifying the exposure to both SOL growth and the fund’s covered call yield strategy. This ensures that the management team shares both the risks and rewards alongside external investors.

Fee Structure

The Solana Covered Call Growth Fund follows a fee model that balances sustainability with investor alignment:

- 2% annual management fee

- 20% quarterly performance fee, calculated with a high-water mark provision to ensure fees are only earned when true new performance is achieved

This structure incentivizes consistent performance while maintaining transparency and fairness for investors.

Strategic Importance for Terramatris LLC

The launch of this fund marks a critical step forward in the evolution of Terramatris LLC. It demonstrates our ability to move beyond experimental trading strategies and establish a professionally structured, traditional-style investment vehicle that can appeal to both crypto-savvy and traditional investors.

This model fund paves the way for:

- Greater institutional credibility through NAV-based valuation.

- A scalable structure for future funds with diversified strategies.

- A disciplined investor base aligned with long-term growth goals.

Our objective is to grow the fund’s value from $100 to $100,000 in a reasonable timeframe, leveraging disciplined trading, prudent risk management, and focused marketing to qualified investors.

The Solana Covered Call Growth Fund represents more than just another crypto product. It embodies our philosophy of combining innovative blockchain opportunities with sound financial structures. By blending SOL’s growth trajectory with the income potential of covered calls, we aim to deliver outsized returns to investors willing to embrace calculated risk.

This launch is not only an investment opportunity p it is a milestone in the professionalization of Terramatris LLC and a strong signal of our long-term commitment to building structured, scalable crypto investment vehicles.